Question: please explain how you got answer Problem 7.05 Stocks A, B, and C have expected returns of 30 percent, 30 percent, and 25 percent, respectively,

please explain how you got answer

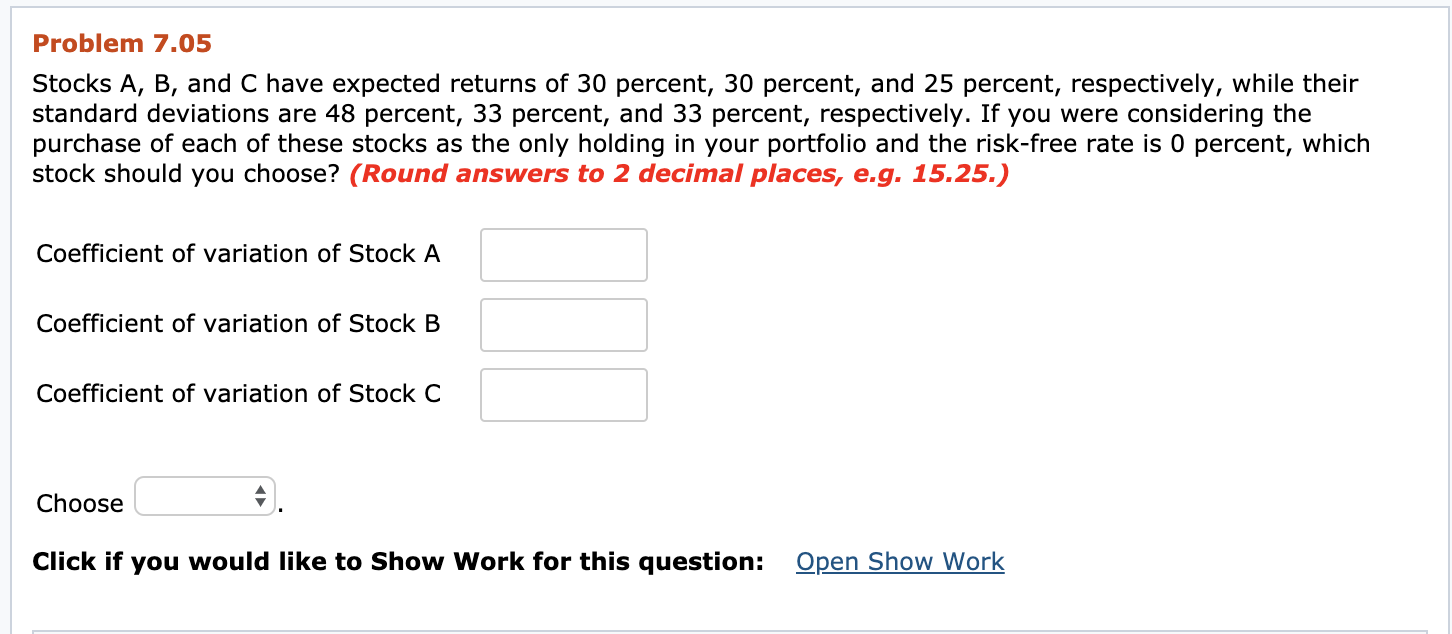

Problem 7.05 Stocks A, B, and C have expected returns of 30 percent, 30 percent, and 25 percent, respectively, while their standard deviations are 48 percent, 33 percent, and 33 percent, respectively. If you were considering the purchase of each of these stocks as the only holding in your portfolio and the risk-free rate is 0 percent, which stock should you choose? (Round answers to 2 decimal places, e.g. 15.25.) Coefficient of variation of Stock A Coefficient of variation of Stock B Coefficient of variation of Stock C Choose Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock