Question: Please explain how you got E. Thanks! Dot and Blot Potts are twins! And they've opened their own cookware business called (you guessed it) Potts'

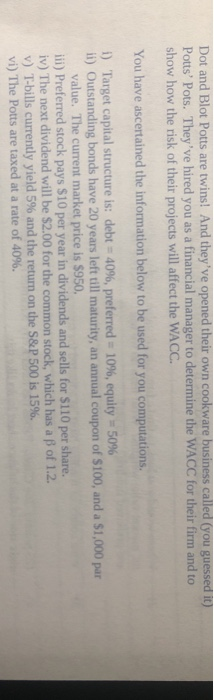

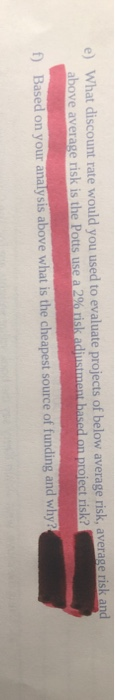

Dot and Blot Potts are twins! And they've opened their own cookware business called (you guessed it) Potts' Pots. They've hired you as a financial manager to determine the WACC for their firm and to show how the risk of their projects will affect the WACC. You have ascertained the information below to be used for you computations. 1) Target capital structure is: debt = 4096, preferred = 10%, equity - 50% ii) Outstanding bonds have 20 years left till maturity, an annual coupon of S100, and a $1,000 par value. The current market price is $950, iii) Preferred stock pays $10 per year in dividends and sells for $110 per share. iv) The next dividend will be $2.00 for the common stock, which has a of 1.2. v) T-bills currently yield 5% and the return on the S&P 500 is 15%. vi) The Potts are taxed at a rate of 40%. e) What discount rate would you used to evaluate projects of below average risk, average risk and above average risk is the Potts use a 2% risk adinstment based on project risk? f) Based on your analysis above what is the cheapest source of funding and why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts