Question: Please explain how you got the answer and it's a one question but broken down into multiple parts Current Attempt in Progress The following CVP

Please explain how you got the answer and it's a one question but broken down into multiple parts

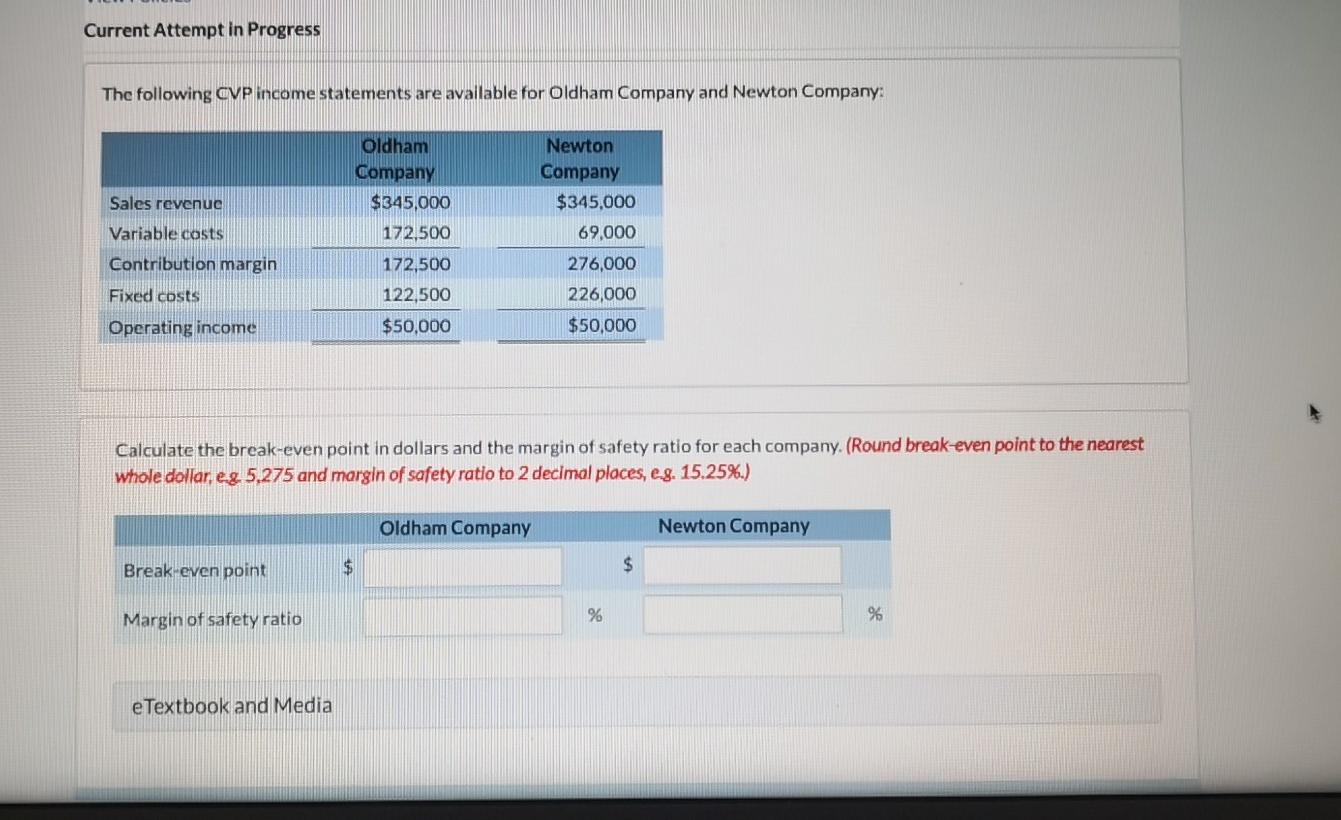

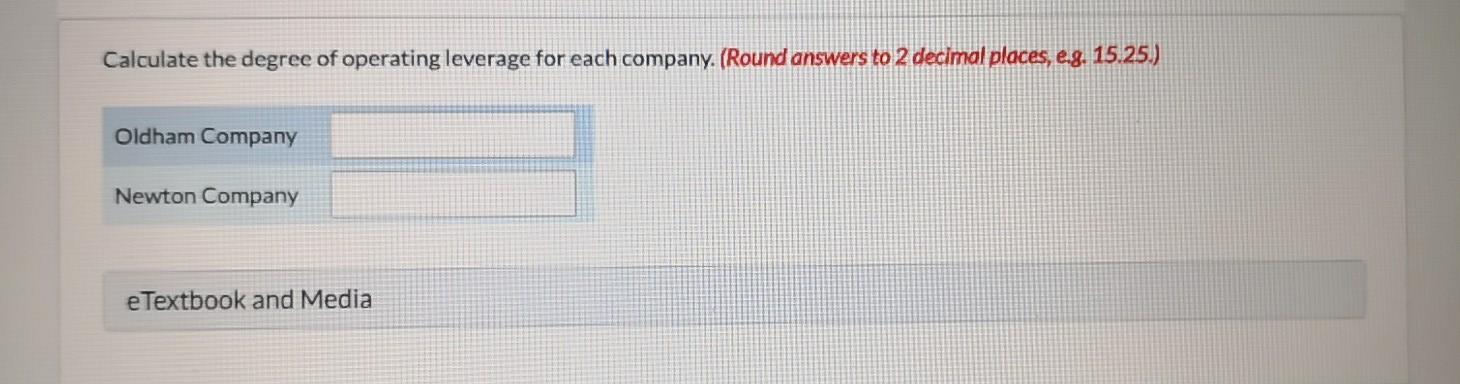

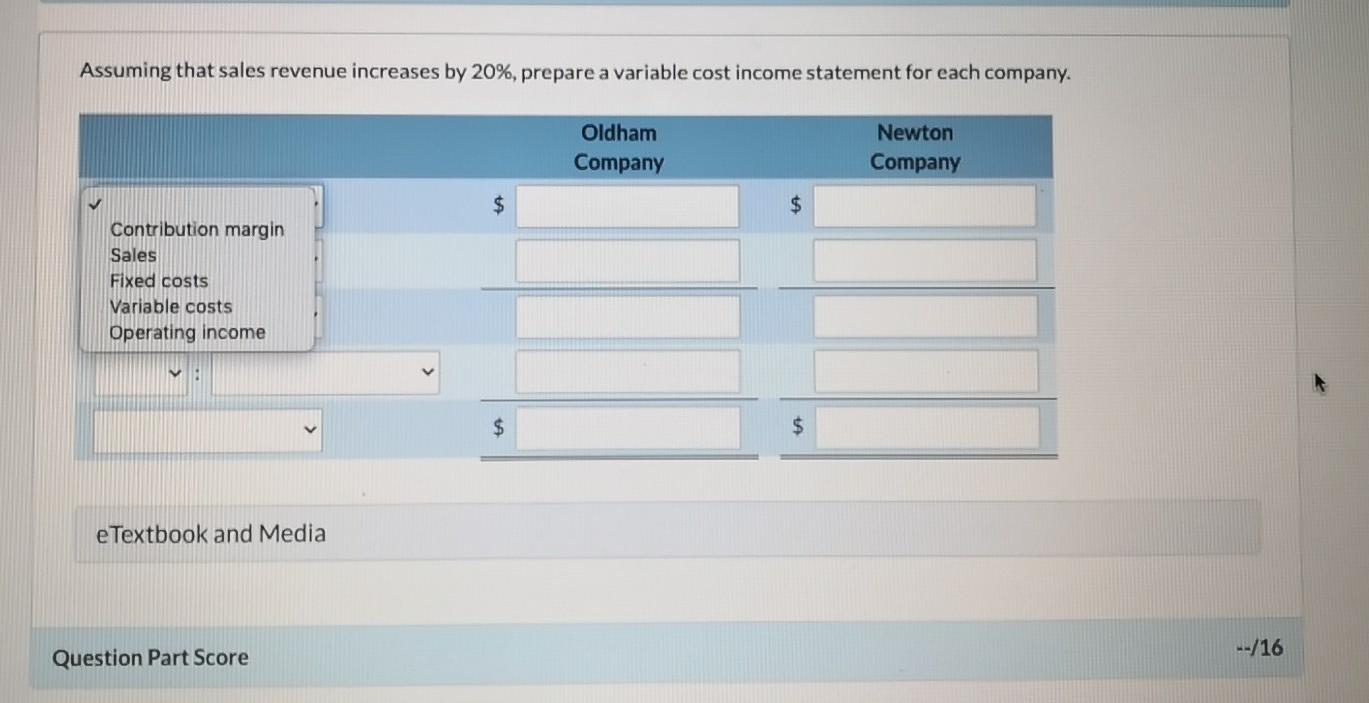

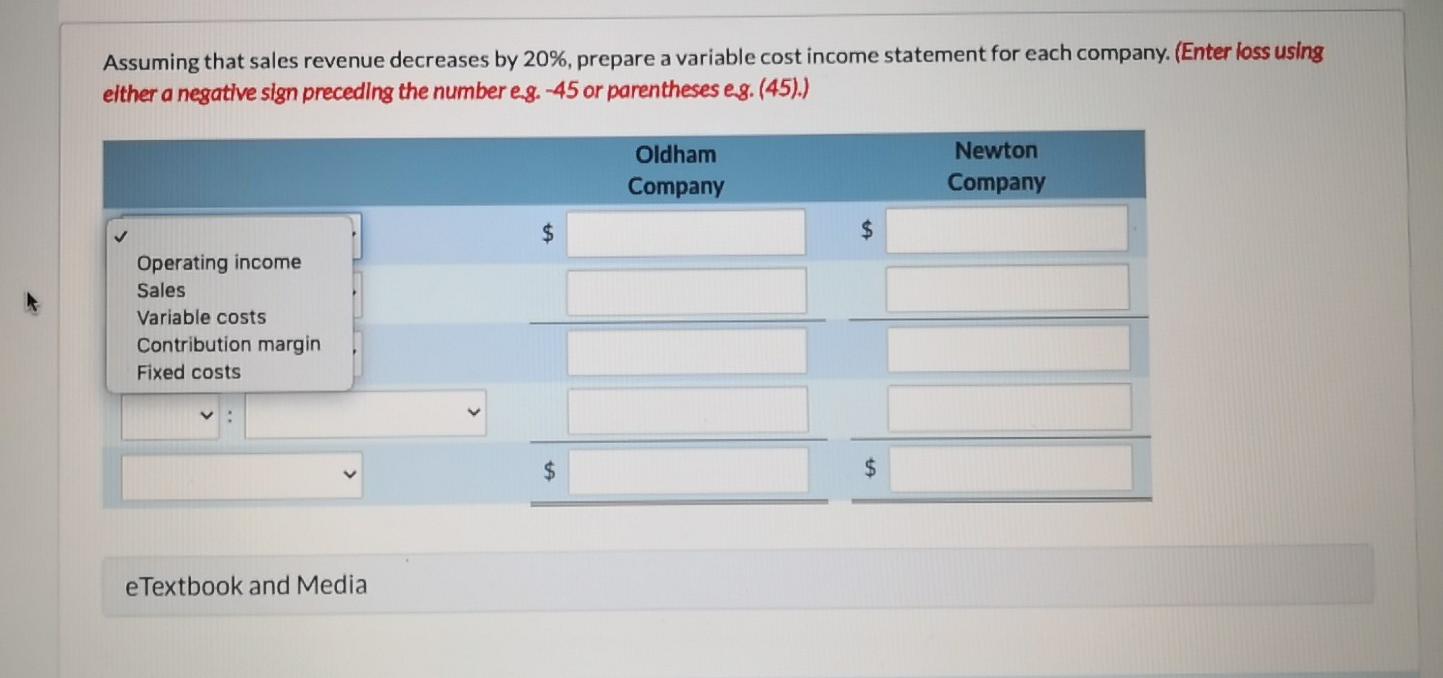

Current Attempt in Progress The following CVP income statements are available for Oldham Company and Newton Company: Oldham Company $345.000 172,500 Sales revenue Variable costs Newton Company $345.000 69,000 276,000 226,000 $50,000 Contribution margin Fixed costs 172,500 122,500 $50,000 Operating income Calculate the break-even point in dollars and the margin of safety ratio for each company. (Round break-even point to the nearest whole dollar, eg 5,275 and margin of safety ratio to 2 decimal places, e.g. 15.25%.) Oldham Company Newton Company Break even point $ $ Margin of safety ratio % e Textbook and Media Calculate the degree of operating leverage for each company. (Round answers to 2 decimal places, e.g. 15.25.) Oldham Company Newton Company e Textbook and Media Assuming that sales revenue increases by 20%, prepare a variable cost income statement for each company. Oldham Company Newton Company $ $ Contribution margin Sales Fixed costs Variable costs Operating income $ $ e Textbook and Media --/16 Question Part Score Assuming that sales revenue decreases by 20%, prepare a variable cost income statement for each company. (Enter loss using elther a negative sign preceding the number eg.-45 or parentheses eg. (45).) Oldham Company Newton Company $ $ Operating income Sales Variable costs Contribution margin Fixed costs $ e Textbook and Media

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts