Question: Please explain how you got the answer and show your work The initial cost of new lily-growing equipment is estimated to be $50,000. This expenditure

Please explain how you got the answer and show your work

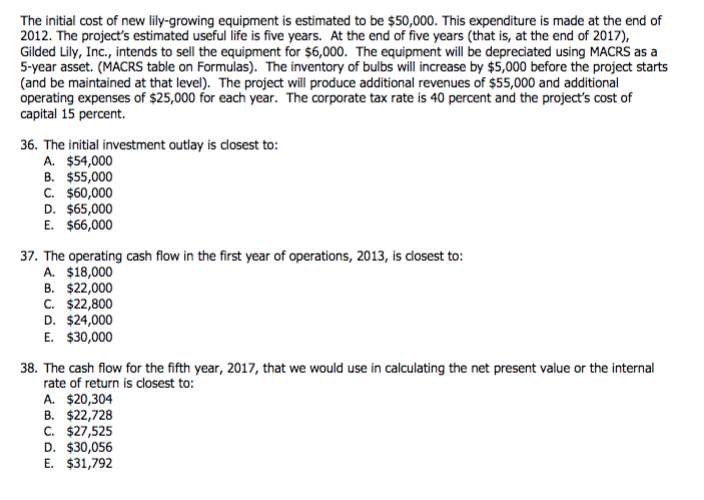

The initial cost of new lily-growing equipment is estimated to be $50,000. This expenditure is made at the end of 2012. The project's estimated useful life is five years. At the end of five years (that is, at the end of 2017), Gilded Lily, Inc., intends to sell the equipment for $6,000. The equipment will be depreciated using MACRS as a 5-year asset. (MACRS table on Formulas). The inventory of bulbs will increase by $5,000 before the project starts (and be maintained at that level). The project will produce additional revenues of $55,000 and additional operating expenses of $25,000 for each year. The corporate tax rate is 40 percent and the project's cost of capital 15 percent. 36. The initial investment outlay is closest to A. $54,000 B. $55,000 C. $60,000 D. $65,000 E. $66,000 37. The operating cash flow in the first year of operations, 2013, is closest to: A. $18,000 B. $22,000 C. $22,800 D. $24,000 E. $30,000 38. The cash flow for the fifth year, 2017, that we would use in calculating the net present value or the internal rate of return is closest to A. $20,304 B. $22,728 C. $7,525 D. $30,056 E. $31,792 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts