Question: please explain how you got the answer Effective credit policy involves establishing credit standards for extending credit to customers, determining the company's credit terms, and

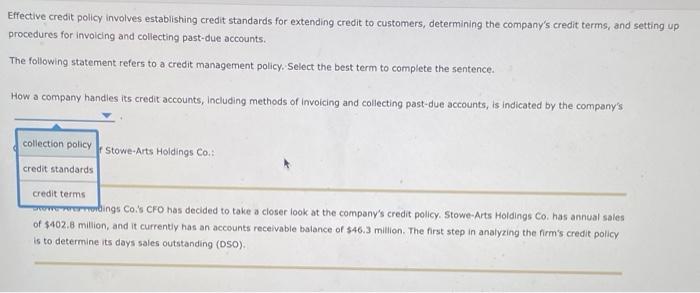

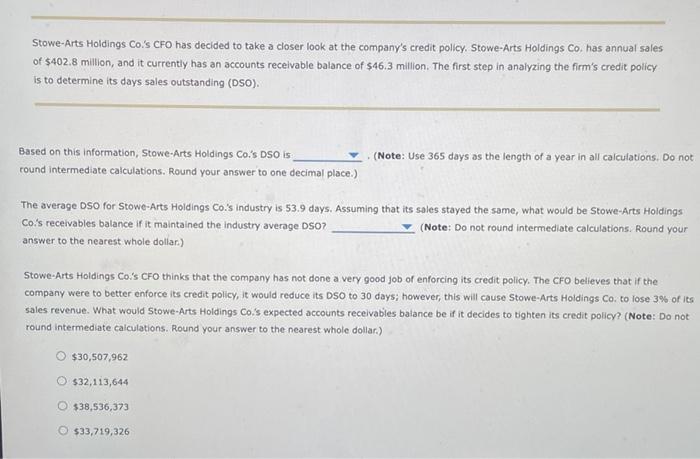

Effective credit policy involves establishing credit standards for extending credit to customers, determining the company's credit terms, and setting up procedures for invoicing and collecting past-due accounts. The following statement refers to a credit management policy. Select the best term to complete the sentence. How a company handles its credit accounts, including methods of invoicing and collecting past-due accounts, is indicated by the company's Stowe-Arts Holdings Co.: collection policy credit standards credit terms Drowe remordings Co.'s CFO has decided to take a closer look at the company's credit policy. Stowe-Arts Holdings Co. has annual sales of $402.8 million, and it currently has an accounts receivable balance of $46.3 million. The first step in analyzing the firm's credit policy is to determine its days sales outstanding (DSO). Stowe-Arts Holdings Co.'s CFO has decided to take a closer look at the company's credit policy. Stowe-Arts Holdings Co. has annual sales of $402.8 million, and it currently has an accounts receivable balance of $46.3 million. The first step in analyzing the firm's credit policy is to determine its days sales outstanding (DSO). Based on this information, Stowe-Arts Holdings Co.'s DSO is (Note: Use 365 days as the length of a year in all calculations. Do not round intermediate calculations. Round your answer to one decimal place.) The average DSO for Stowe-Arts Holdings Co.'s industry is 53.9 days. Assuming that its sales stayed the same, what would be Stowe-Arts Holdings Co.'s receivables balance if it maintained the industry average DSO? (Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar.) Stowe-Arts Holdings Co.'s CFO thinks that the company has not done a very good job of enforcing its credit policy. The CFO believes that if the company were to better enforce its credit policy, it would reduce its DSO to 30 days; however, this will cause Stowe-Arts Holdings Co. to lose 3% of its sales revenue. What would Stowe-Arts Holdings Co.'s expected accounts receivables balance be if it decides to tighten its credit policy? (Note: Do not round intermediate calculations. Round your answer to the nearest whole dollar.) O $30,507,962 $32,113,644 $38,536,373 $33,719,326

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts