Question: please explain how you got the answer so i can understand Present and future value tables of $1 at 3% are presented below: 3 10

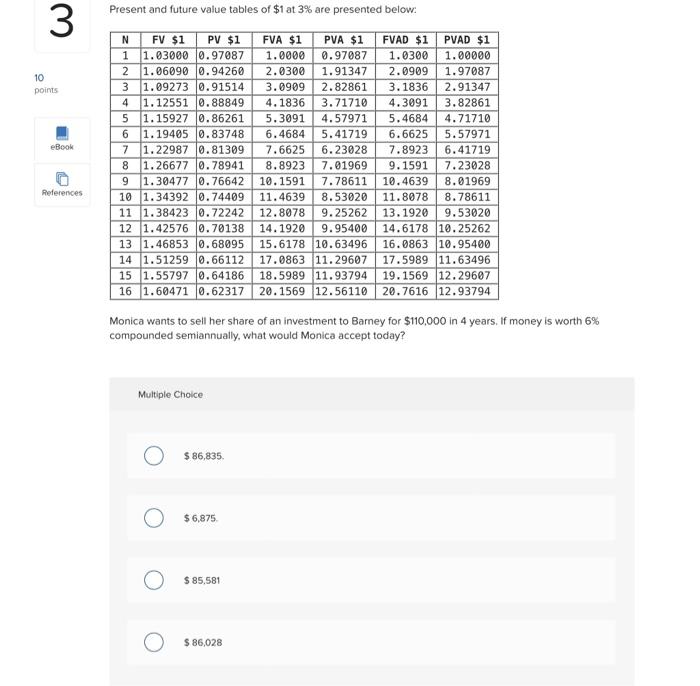

Present and future value tables of $1 at 3% are presented below: 3 10 points ZINMON cool FV $1 PV $1 FVA $1 PVA $1 1 1.03000 0.97087 1.0000 0.97087 2 1.06090 0.94260 2.0300 1.91347 3 1.09273 0.91514 3.0909 2.82861 4 1.12551 0.88849 4.1836 3.71710 5 1.15927 0.86261 5.3091 4.57971 6 1.19405 0.83748 6.4684 5.41719 7 1.22987 0.81309 7.6625 6.23028 8 1.26677 0.78941 8.8923 7.01969 9 1.30477 0.76642 10.1591 7.78611 10 1.34392 0.74409 11.4639 8.53020 11 1.38423 0.72242 12.8078 9.25262 12 1.42576 0.70138 14.1920 9.95400 13 1.46853 0.68095 15.6178 10.63496 14 1.51259 0.66112 17.0863 11.29607 15 1.55797 0.64186 18.5989 11.93794 16 1.60471 0.62317 20.1569 12.56110 eBook FVAD $1 PVAD $1 1.0300 1.00000 2.0909 1.97087 3.1836 2.91347 4.3091 3.82861 5.4684 4.71710 6.6625 5.57971 7.8923 6.41719 9.1591 7.23028 10.4639 8.01969 11.8078 8.78611 13. 1920 9.53020 14.6178 10.25262 16.0863 10.95400 17.5989 11.63496 19.1569 12.29607 20.7616 12.93794 References - 1 Monica wants to sell her share of an investment to Barney for $110,000 in 4 years. If money is worth 6% compounded semiannually, what would Monica accept today? Multiple Choice $ 86,835 $ 6,875 $ 85,581 $ 86,028

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts