Question: Please explain how you got the journal entry ( Using allowance method ) - The adjusting entry to record the estimate for uncollectible credit sales

Please explain how you got the journal entry ( Using allowance method )

Please explain how you got the journal entry ( Using allowance method )

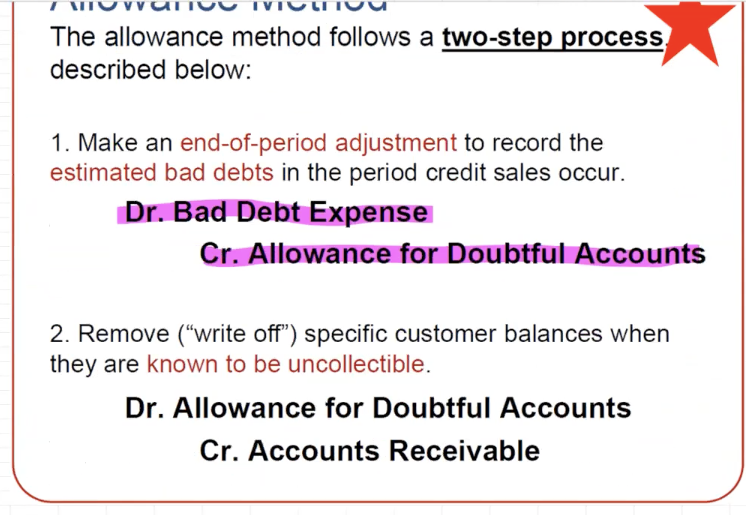

- The adjusting entry to record the estimate for uncollectible credit sales includes a DEBIT to: - The adjusting entry to record the estimate for uncollectible credit sales includes a CREDIT to: - The entry to write-off (remove) a specific account that is determined to be uncollectible includes a DEBIT to: The entry to write-off (remove) a specific account that The allowance method follows a two-step process described below: 1. Make an end-of-period adjustment to record the estimated bad debts in the period credit sales occur. Dr. Bad Debt Expense Cr. Allowance for Doubtful Accounts 2. Remove ("write off") specific customer balances when they are known to be uncollectible. Dr. Allowance for Doubtful Accounts Cr. Accounts Receivable - The adjusting entry to record the estimate for uncollectible credit sales includes a DEBIT to: - The adjusting entry to record the estimate for uncollectible credit sales includes a CREDIT to: - The entry to write-off (remove) a specific account that is determined to be uncollectible includes a DEBIT to: The entry to write-off (remove) a specific account that The allowance method follows a two-step process described below: 1. Make an end-of-period adjustment to record the estimated bad debts in the period credit sales occur. Dr. Bad Debt Expense Cr. Allowance for Doubtful Accounts 2. Remove ("write off") specific customer balances when they are known to be uncollectible. Dr. Allowance for Doubtful Accounts Cr. Accounts Receivable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts