Question: PLEASE EXPLAIN HOW YOU GOT TO YOUR ANSWER SO I CAN UNDERSTAND. Customer refunds, allowances, and returns On April 23, Stilwell Inc. sold $15,000 of

PLEASE EXPLAIN HOW YOU GOT TO YOUR ANSWER SO I CAN UNDERSTAND.

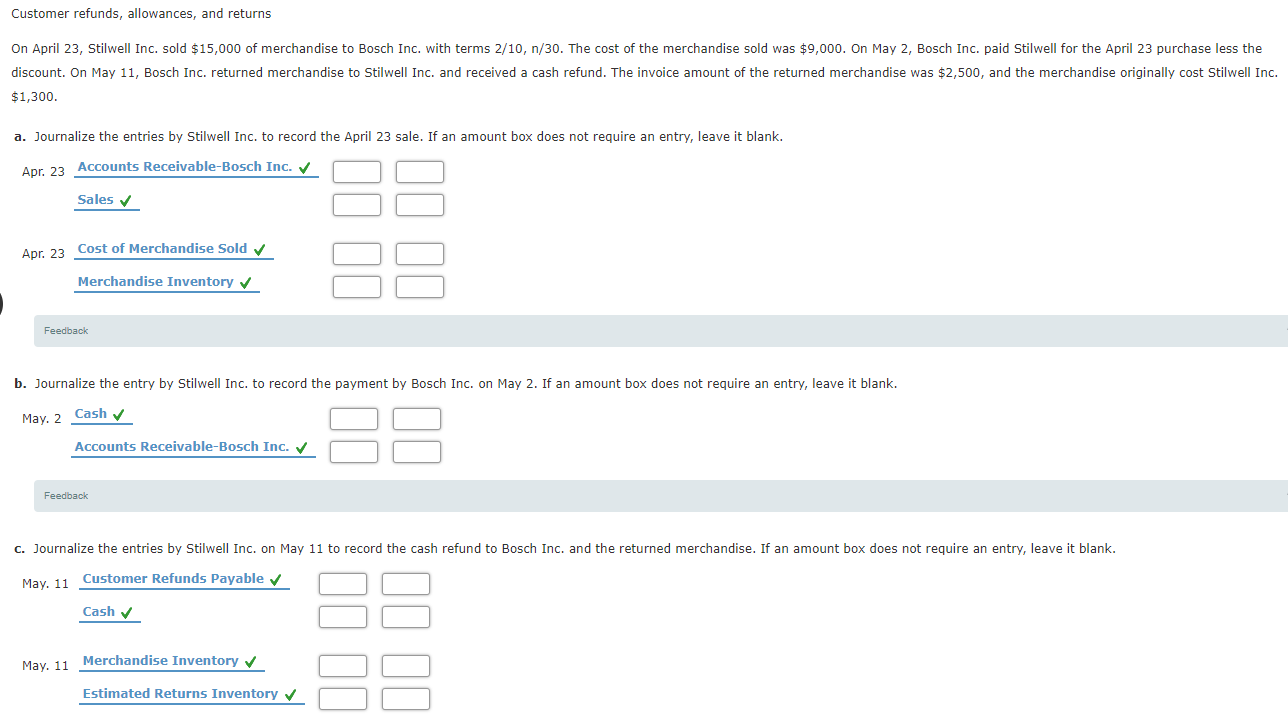

Customer refunds, allowances, and returns On April 23, Stilwell Inc. sold $15,000 of merchandise to Bosch Inc. with terms 2/10, n/30. The cost of the merchandise sold was $9,000. On May 2, Bosch Inc. paid Stilwell for the April 23 purchase less the discount. On May 11, Bosch Inc. returned merchandise to Stilwell Inc. and received a cash refund. The invoice amount of the returned merchandise was $2,500, and the merchandise originally cost Stilwell Inc. $1,300. a. Journalize the entries by Stilwell Inc. to record the April 23 sale. If an amount box does not require an entry, leave it blank. Apr. 23 Accounts Receivable-Bosch Inc. Sales Apr. 23 Cost of Merchandise Sold Merchandise Inventory Feedback b. Journalize the entry by Stilwell Inc. to record the payment by Bosch Inc. on May 2. If an amount box does not require an entry, leave it blank. May 2 Cash 10 Accounts Receivable-Bosch Inc. Feedback C. Journalize the entries by Stilwell Inc. on May 11 to record the cash refund to Bosch Inc. and the returned merchandise. If an amount box does not require an entry, leave it blank. May. 11 Customer Refunds Payable Cash II II II II May. 11 Merchandise Inventory Estimated Returns Inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts