Question: PLease explain how you got to your answer. Thank you. Evaluate the following stock price information for XP Corporation and Ace, Inc. Year 2010 $9.75

PLease explain how you got to your answer. Thank you.

PLease explain how you got to your answer. Thank you.

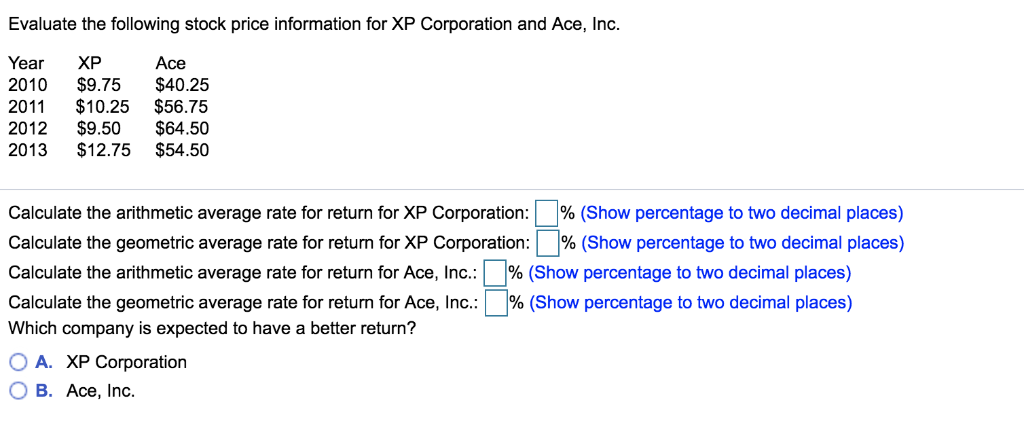

Evaluate the following stock price information for XP Corporation and Ace, Inc. Year 2010 $9.75 $40.25 2011 $10.25 $56.75 2012 $9.50 $64.50 2013 $12.75 $54.50 XP Ace Calculate the arithmetic average rate for return for P Corporation: % Show percentage to two decimal places Calculate the geometric average rate for return for XP Corporation: % Show percentage to two decimal places) Calculate the arithmetic average rate for return for Ace, Inc. : | % (Show percentage to two decimal places) Calculate the geometric average rate for return for Ace, Inc. : % (Show percentage to two decimal places) Which company is expected to have a better return? O A. XP Corporation O B. Ace, Inc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts