Question: Please explain how you got your answer 2) Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by

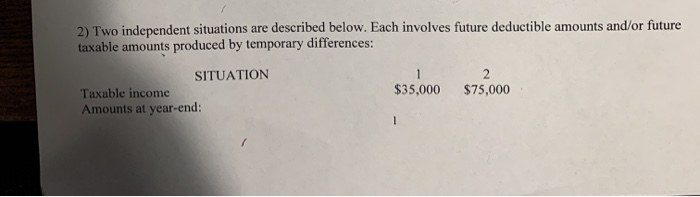

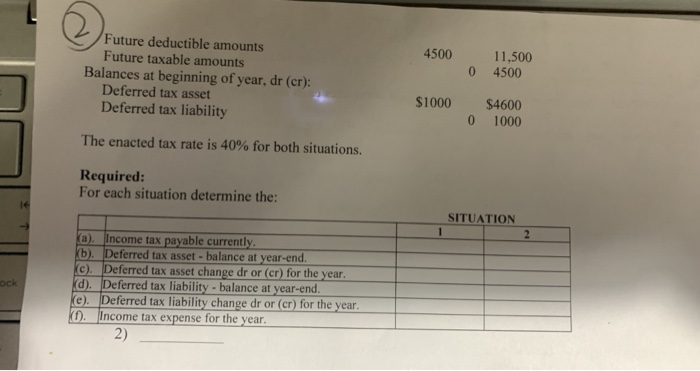

2) Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences: SITUATION Taxable income Amounts at year-end: $35,000 $75,000 4500 11,500 4500 0 Future deductible amounts Future taxable amounts Balances at beginning of year, dr (er): Deferred tax asset Deferred tax liability $1000 0 $4600 1000 The enacted tax rate is 40% for both situations. Required: For each situation determine the: SITUATION ka). Income tax payable currently Kb). Deferred tax asset - balance at year-end. Kc). Deferred tax asset change dr or (cr) for the year. d). Deferred tax liability - balance at year-end. ke). Deferred tax liability change dr or (cr) for the year. kt). Income tax expense for the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts