Question: please explain how you got your answer QUESTION 3 Not complete Points out of 4.00o Flag question come Planning Superior Corporation sells a single product

please explain how you got your answer

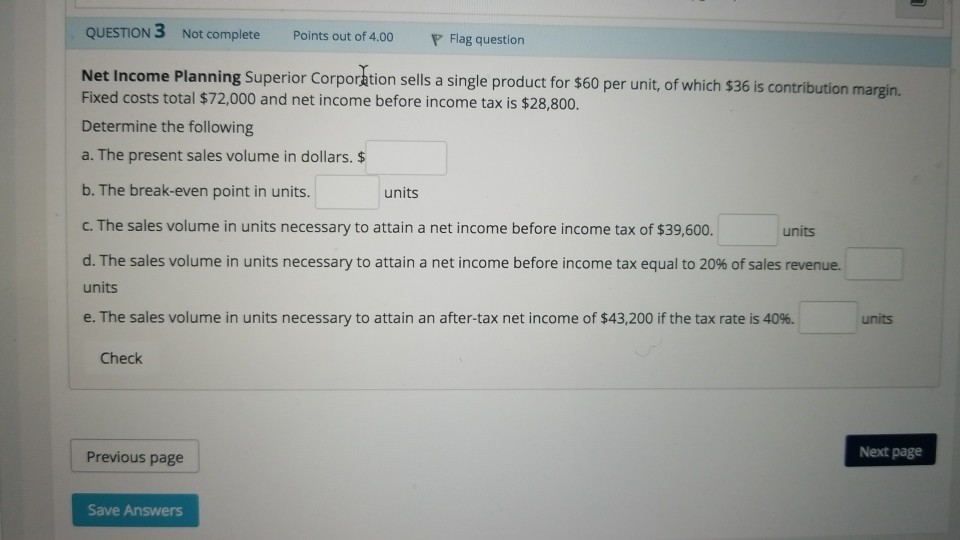

QUESTION 3 Not complete Points out of 4.00o Flag question come Planning Superior Corporation sells a single product for $60 per unit, of which $36 is contribution margin. Net In Fixed costs total $72,000 and net income before income tax is $28,800. Determine the following a. The present sales volume in dollars.$ b. The break-even point in units. c. The sales volume in units necessary to attain a net income before income tax of $39,600. d. The sales volume in units necessary to attain a net income before income tax equal to 20% of sales revenue. units e. The sales volume in units necessary to attain an after-tax net income of $43,200 if the tax rate is 40%. units units units Check Previous page Next page Save Answers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts