Question: please explain how you got your answer! Required information Problem 17-6AA (Algo) Income statement computations and format LO A2 [The following information applies to the

![the questions displayed below.] Selected account balances from the adjusted trial balance](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/67184b62da98c_41067184b6278668.jpg)

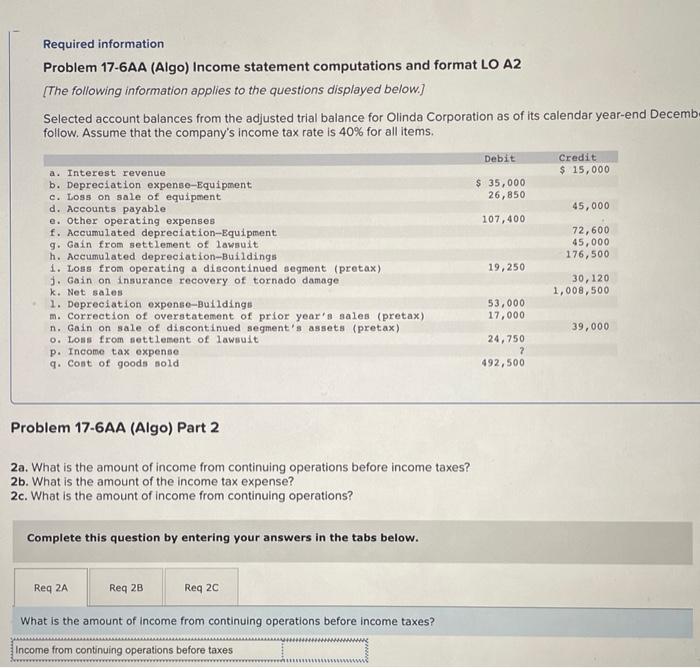

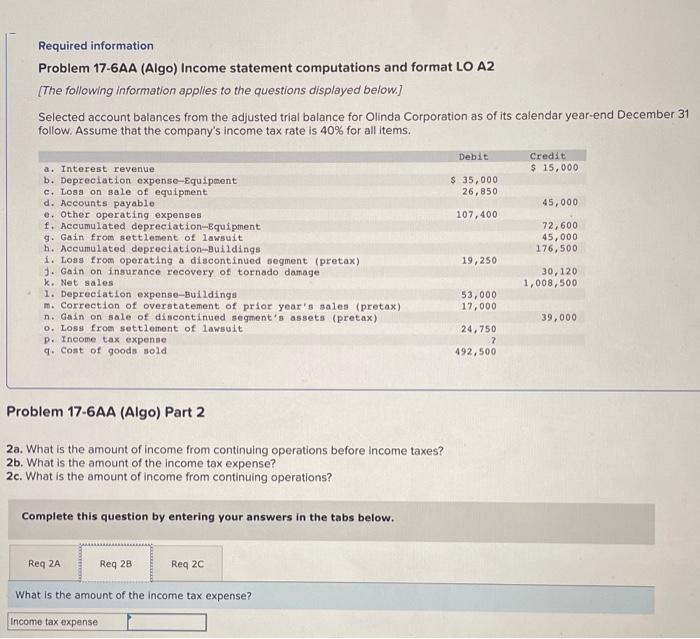

Required information Problem 17-6AA (Algo) Income statement computations and format LO A2 [The following information applies to the questions displayed below.] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end Decemb follow. Assume that the company's income tax rate is 40% for all items. Problem 17-6AA (Algo) Part 2 2a. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income tax expense? 2c. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. What is the amount of income from continuing operations before income taxes? Required information Problem 17-6AA (Algo) Income statement computations and format LO A2 [The following information applies to the questions displayed below.] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company's income tax rate is 40% for all items. Problem 17-6AA (Algo) Part 2 2a. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income tax expense? 2c. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. What is the amount of the income tax expense? Required information Problem 17-6AA (Algo) Income statement computations and format LO A2 [The following information applies to the questions displayed below] Selected account balances from the adjusted trial balance for Olinda Corporation as of its calendar year-end December 31 follow. Assume that the company's income tax rate is 40% for all items. Problem 17-6AA (Algo) Part 2 2a. What is the amount of income from continuing operations before income taxes? 2b. What is the amount of the income tax expense? 2 c. What is the amount of income from continuing operations? Complete this question by entering your answers in the tabs below. What is the amount of Income from continuing operations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts