Question: please explain i dont know what im doing wrong Witter House is a calendar-year firm with 500 million common shares outstanding throughout 2024 and 2025.

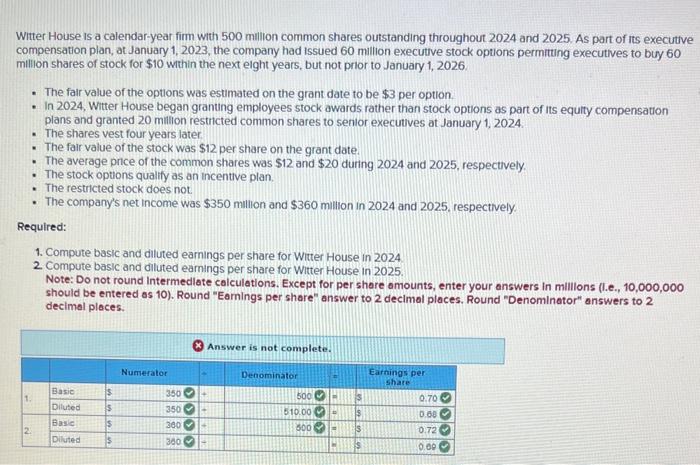

Witter House is a calendar-year firm with 500 million common shares outstanding throughout 2024 and 2025. As part of its executtve compensation plan, at January 1, 2023, the company had issued 60 million executive stock options permitung executives to buy 60 milion shares of stock for $10 wthin the next elght years, but not prior to January 1, 2026. - The fair value of the options was estimated on the grant date to be $3 per option. - In 2024, Witter House began granting employees stock awards rather than stock options as part of its equity compensation plans and granted 20 milion resticted common shares to senlor executives at January 1, 2024. - The shares vest four years later - The fair value of the stock was $12 per share on the grant date. - The average price of the common shares was $12 and $20 during 2024 and 2025 , respectively. - The stock optons qualify as an incentive plan. - The restricted stock does not - The company's net income was $350 milion and $360 milion in 2024 and 2025, respectively. Required: 1. Compute basic and diluted earnings per share for Witter House in 2024 2. Compute basic and diluted eamings per share for Witter House in 2025. Note: Do not round Intermediate calculations. Except for per share omounts, enter your answers in millions (l.e., 10,000,000 should be entered as 10). Round "Earnings per share" answer to 2 decimal places. Round "Denominator" answers to 2 decimal ploces

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts