Question: Please explain. I know the answer is 1,060,000 but can someone explain how the COGS reported by park on sale to small is .40? Chapter

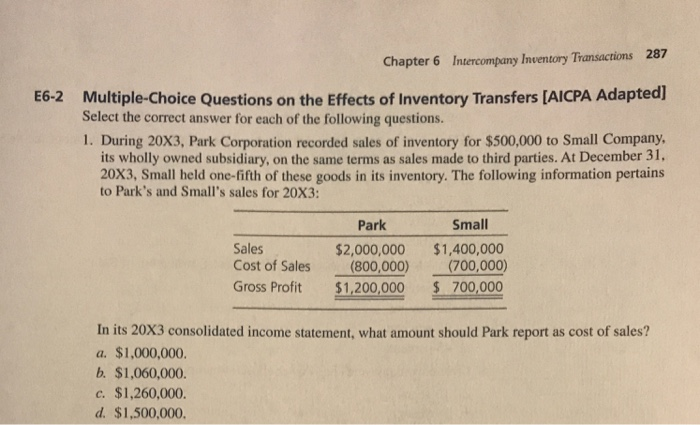

Chapter 6 Intercompany Invetory Transactions 287 E6-2 Multiple-Choice Questions on the Effects of Inventory Transfers [AICPA Adapted] Select the correct answer for each of the following questions. I. During 20X3, Park Corporation recorded sales of mventory for $500,000 to Small Company, its wholly owned subsidiary, on the same terms as sales made to third parties. At December 31. 20X3, Small held one-fifth of these goods in its inventory. The following information pertains to Park's and Small's sales for 20X3: Park Small Sales Cost of Sales (800,000) Gross Profit $1,200,000 $2,000,000 $1,400,000 (700,000) 700,000 In its 20X3 consolidated income statement, what amount should Park report as cost of sales? a. $1,000,000 b. $1,060,000 c. $1,260,000 d. $1,500,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts