Question: Please explain in 3 to 4 sentences why the INCORRECT answers are INCORRECT. Also, please explain in 3 to 4 sentences why the CORRECT answer

Please explain in 3 to 4 sentences why the INCORRECT answers are INCORRECT.

Also, please explain in 3 to 4 sentences why the CORRECT answer is CORRECT.

Thanks for the help.

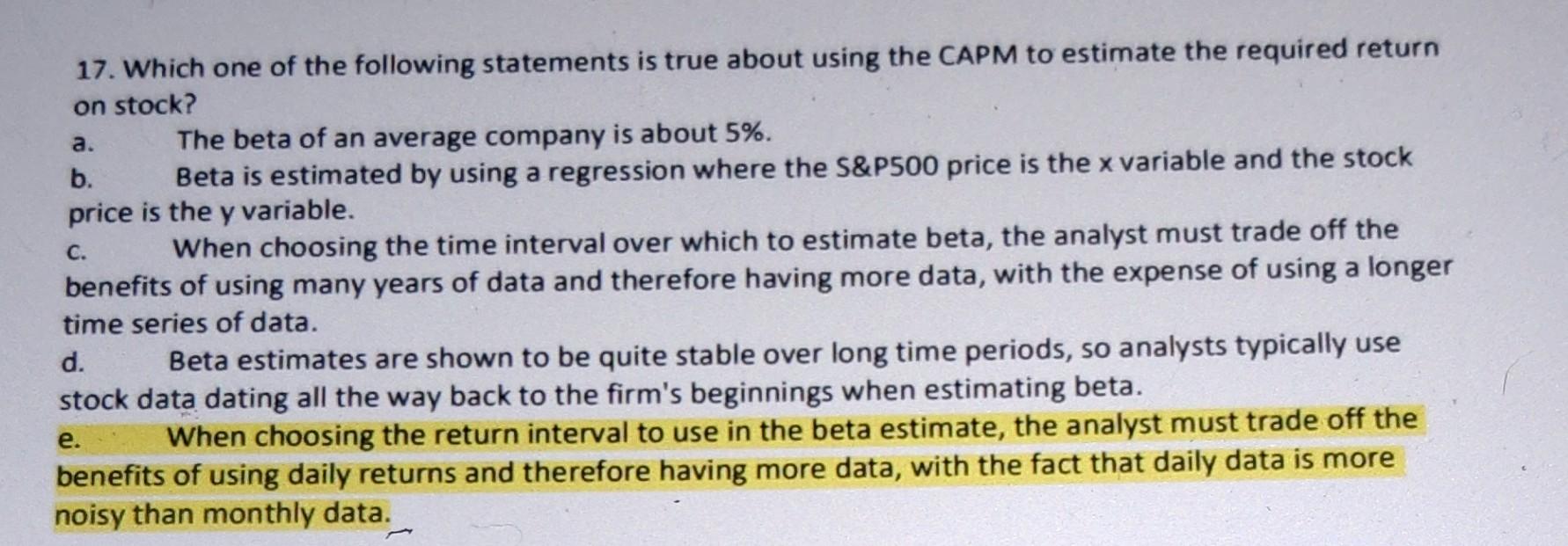

17. Which one of the following statements is true about using the CAPM to estimate the required return on stock? a. The beta of an average company is about 5%. b. Beta is estimated by using a regression where the S\&P500 price is the x variable and the stock price is the y variable. c. When choosing the time interval over which to estimate beta, the analyst must trade off the benefits of using many years of data and therefore having more data, with the expense of using a longer time series of data. d. Beta estimates are shown to be quite stable over long time periods, so analysts typically use stock data dating all the way back to the firm's beginnings when estimating beta. e. When choosing the return interval to use in the beta estimate, the analyst must trade off the benefits of using daily returns and therefore having more data, with the fact that daily data is more noisy than monthly data

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts