Question: Please explain in a paragraph why the highlighted answer is the correct answer. For each incorrect answer please explain in a paragraph why it is

Please explain in a paragraph why the highlighted answer is the correct answer. For each incorrect answer please explain in a paragraph why it is incorrect.

I'm trying to get a better understanding. Thanks for the help

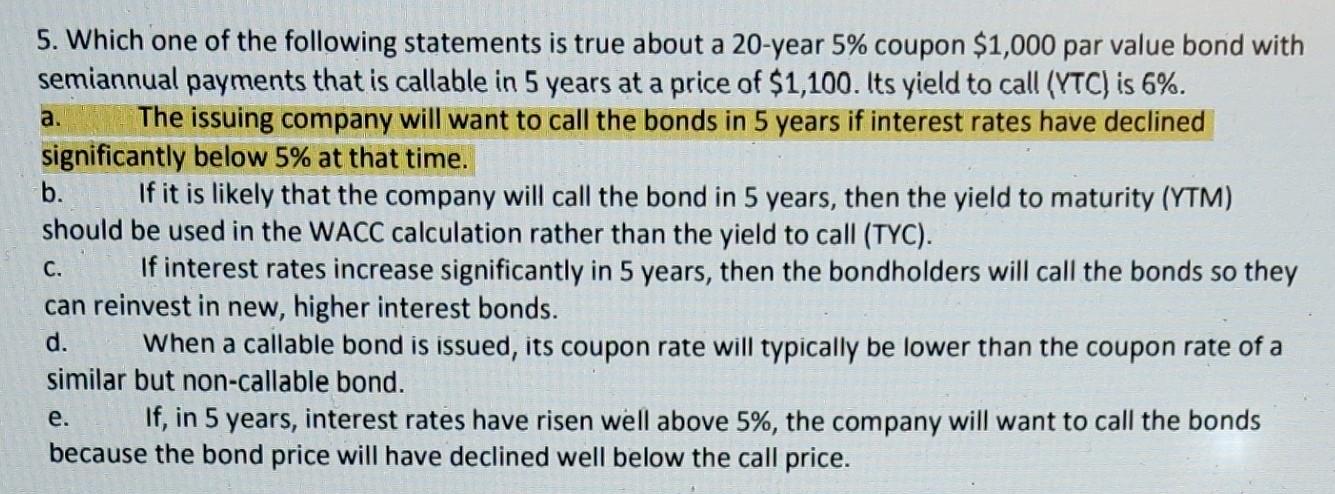

5. Which one of the following statements is true about a 20 -year 5% coupon $1,000 par value bond with semiannual payments that is callable in 5 years at a price of $1,100. Its yield to call (YTC) is 6%. a. The issuing company will want to call the bonds in 5 years if interest rates have declined significantly below 5% at that time. b. If it is likely that the company will call the bond in 5 years, then the yield to maturity (YTM) should be used in the WACC calculation rather than the yield to call (TYC). c. If interest rates increase significantly in 5 years, then the bondholders will call the bonds so they can reinvest in new, higher interest bonds. d. When a callable bond is issued, its coupon rate will typically be lower than the coupon rate of a similar but non-callable bond. e. If, in 5 years, interest rates have risen well above 5%, the company will want to call the bonds because the bond price will have declined well below the call price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts