Question: Please explain in as much detail as possible, I'm trying to study for the final and want to understand these questions. Thank you so much

Please explain in as much detail as possible, I'm trying to study for the final and want to understand these questions. Thank you so much

Please explain in as much detail as possible, I'm trying to study for the final and want to understand these questions. Thank you so much

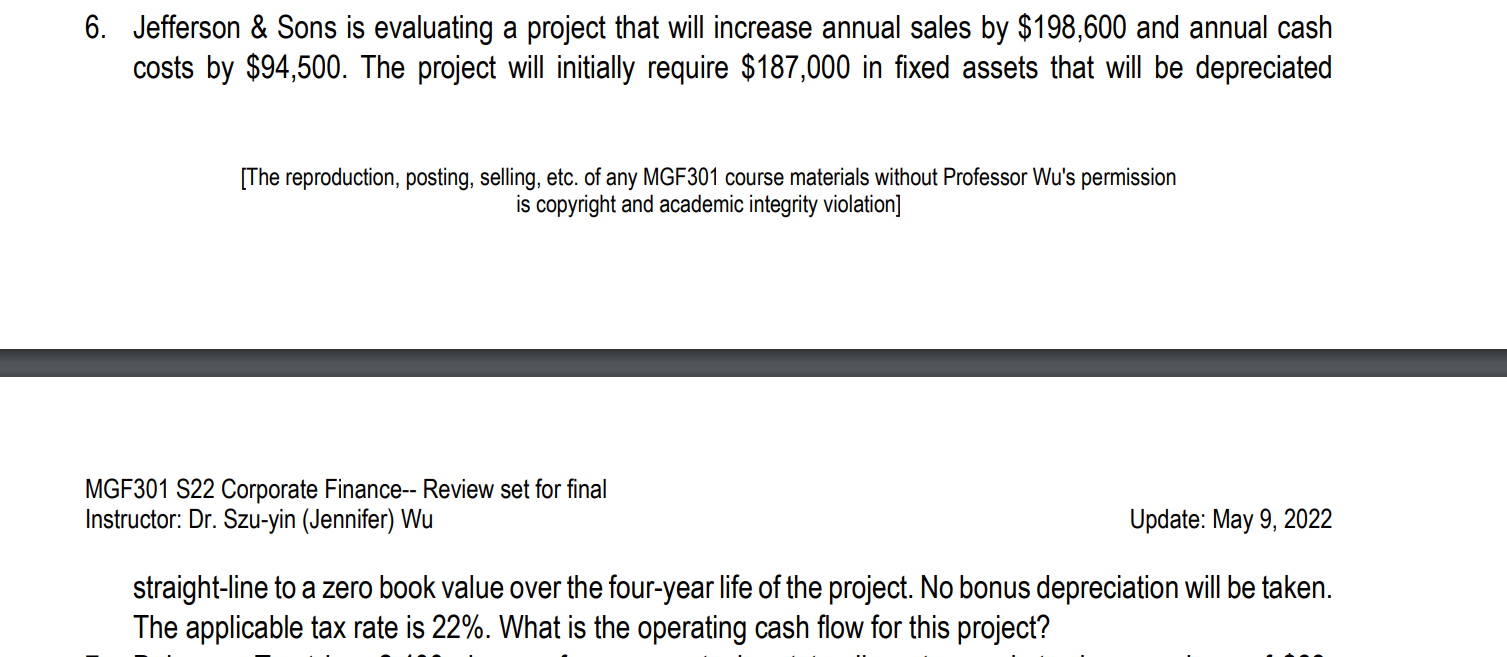

6. Jefferson & Sons is evaluating a project that will increase annual sales by $198,600 and annual cash costs by $94,500. The project will initially require $187,000 in fixed assets that will be depreciated [The reproduction, posting, selling, etc. of any MGF301 course materials without Professor Wu's permission is copyright and academic integrity violation] MGF301 S22 Corporate Finance-- Review set for final Instructor: Dr. Szu-yin (Jennifer) Wu Update: May 9, 2022 straight-line to a zero book value over the four-year life of the project. No bonus depreciation will be taken. The applicable tax rate is 22%. What is the operating cash flow for this project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts