Question: Please explain in detail and type or write as neatly as possible. Thanks. 5. On February 2, 2016, an investor held some Province of Ontario

Please explain in detail and type or write as neatly as possible. Thanks.

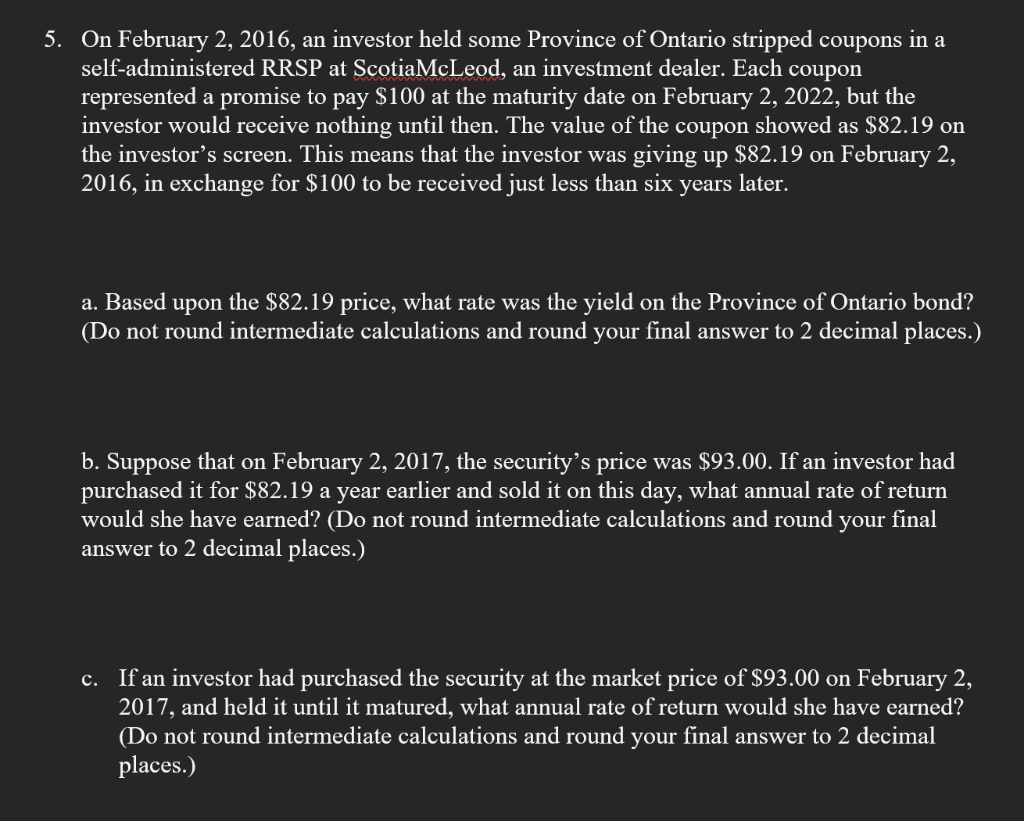

5. On February 2, 2016, an investor held some Province of Ontario stripped coupons in a self-administered RRSP at ScotiaMcLeod, an investment dealer. Each coupon represented a promise to pay $100 at the maturity date on February 2, 2022, but the investor would receive nothing until then. The value of the coupon showed as $82.19 on the investor's screen. This means that the investor was giving up $82.19 on February 2, 2016, in exchange for $100 to be received just less than six years later. a. Based upon the $82.19 price, what rate was the yield on the Province of Ontario bond? (Do not round intermediate calculations and round your final answer to 2 decimal places.) b. Suppose that on February 2, 2017, the security's price was $93.00. If an investor had purchased it for $82.19 a year earlier and sold it on this day, what annual rate of return would she have earned? (Do not round intermediate calculations and round your final answer to 2 decimal places.) c. If an investor had purchased the security at the market price of $93.00 on February 2, 2017, and held it until it matured, what annual rate of return would she have earned? (Do not round intermediate calculations and round your final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts