Question: Please explain in detail how the CAPM was solved for? Cost of debt Risk-free rate of Return Beta & R(m) CAPM Calculation of Cost of

Please explain in detail how the "CAPM" was solved for?

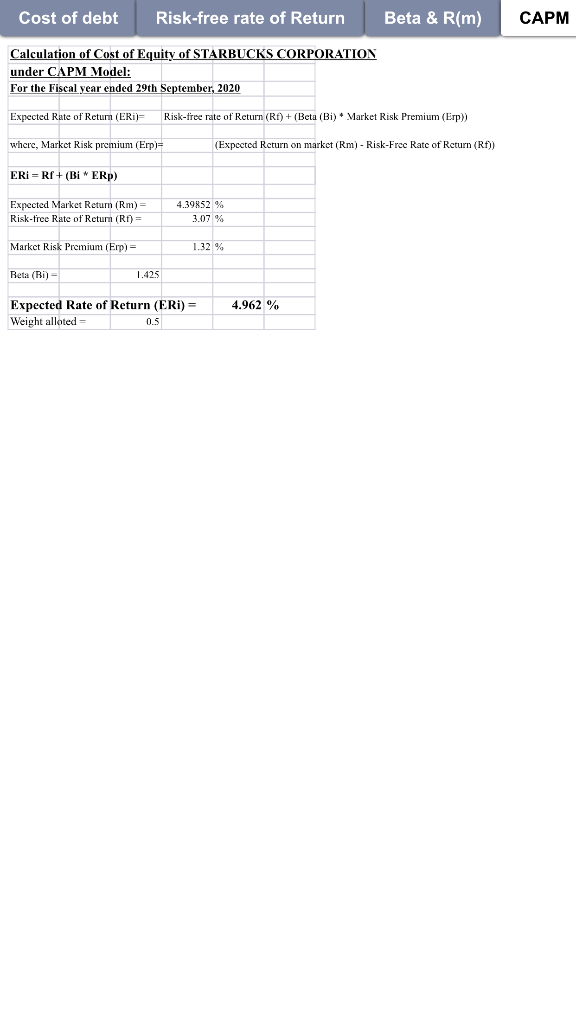

Cost of debt Risk-free rate of Return Beta & R(m) CAPM Calculation of Cost of Equity of STARBUCKS CORPORATION under CAPM Model: For the Fiscal year ended 29th September, 2020 Expected Rate of Return (ERI)= Risk-free rate of Return (Rt) + (Beta (Bi). Market Risk Premium (Erp)) where, Market Risk premium (Erp)= (Expected Return on market (Rm) - Risk-Free Rate of Return (Rt)) ERIRI+(Bi ERP) Expected Market Return (Rm) = Risk-free Rate of Return (Rt) = 4.39852 3.07% Market Risk Premium (Erp) 1.32% Reta (Bi) 1.425 4.962 % Expected Rate of Return (ERI) = Weight alloted 05

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts