Question: Please explain in detail how we get the change in working capital Jakie and Chan are planning to invest in Talanoa Treks Ski project. The

Please explain in detail how we get the change in working capital

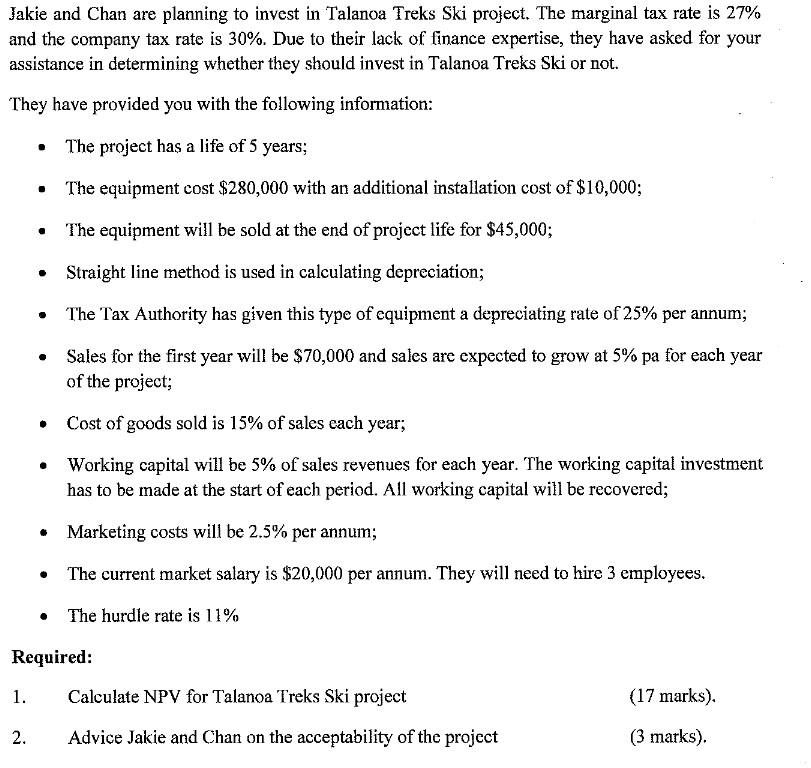

Jakie and Chan are planning to invest in Talanoa Treks Ski project. The marginal tax rate is 27% and the company tax rate is 30%. Due to their lack of finance expertise, they have asked for your assistance in determining whether they should invest in Talanoa Treks Ski or not. They have provided you with the following information: The project has a life of 5 years; The equipment cost $280,000 with an additional installation cost of $10,000; The equipment will be sold at the end of project life for $45,000; . . Straight line method is used in calculating depreciation; The Tax Authority has given this type of equipment a depreciating rate of 25% per annum; Sales for the first year will be $70,000 and sales are expected to grow at 5% pa for each year of the project; Cost of goods sold is 15% of sales cach year; Working capital will be 5% of sales revenues for each year. The working capital investment has to be made at the start of each period. All working capital will be recovered; . Marketing costs will be 2.5% per annum; The current market salary is $20,000 per annum. They will need to hire 3 employees. The hurdle rate is 11% Required: 1. Calculate NPV for Talanoa Treks Ski project (17 marks). 2. Advice Jakie and Chan on the acceptability of the project

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts