Question: Please explain in detail why each answer is incorrect and why the correct answer is correct. Why is COGS less the increase in inventory $323?

Please explain in detail why each answer is incorrect and why the correct answer is correct.

Why is COGS less the increase in inventory $323? What is the formula? Why is this formula used?

Why specifically is C correct?

Why does inventory increase during the year by 14.8 million but not because of the transaction entered?

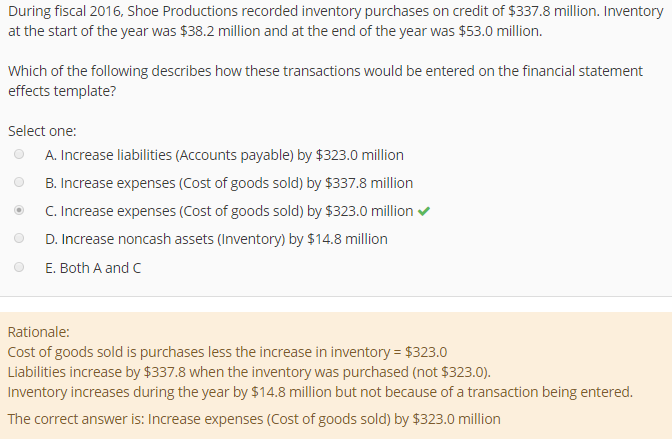

During fiscal 2016, Shoe Productions recorded inventory purchases on credit of $337.8 million. Inventory at the start of the year was $38.2 million and at the end of the year was $53.0 million Which of the following describes how these transactions would be entered on the financial statement effects template? Select one: A. Increase liabilities (Accounts payable) by $323.0 million B. Increase expenses (Cost of goods sold) by $337.8 million C. Increase expenses (Cost of goods sold) by $323.0 million D. Increase noncash assets (Inventory) by $14.8 million E. Both A and C Rationale: Cost of goods sold is purchases less the increase in inventory $323.0 Liabilities increase by $337.8 when the inventory was purchased (not $323.0). Inventory increases during the year by $14.8 million but not because of a transaction being entered. The correct answer is: Increase expenses (Cost of goods sold) by $323.0 million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts