Question: Please explain in detail(Please don't use Excel to solve) show work: West Coast Chemical Company is considering two mutually exclusive investments. The firm currently faces

Please explain in detail(Please don't use Excel to solve) show work:

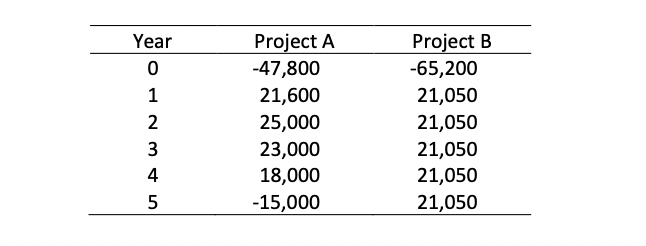

West Coast Chemical Company is considering two mutually exclusive investments. The firm currently faces a cost of capital of 12.5%. The projects expected net cash flows are as follows:

a. Determine the NPV for both Projects A and B. Which project should be chosen? Explain. b. Determine the IRR and MIRR for both Projects A and B (given a reinvestment rate of 11%). Which project should be chosen? Explain. c. At what cost of capital would the NPV profiles of the two projects cross each other? What is the significance of this crossover rate in a managers ranking of the projects? Explain.

O Year 0 1 2 3 4 5 Project A -47,800 21,600 25,000 23,000 18,000 -15,000 Project B -65,200 21,050 21,050 21,050 21,050 21,050 min

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts