Question: Please explain in details only part a. With formulas and explanations..... NONCONSTANT GROWTH STOCK VALUATION Taussig Technologies Corporation (TTC) has been growing at a rate

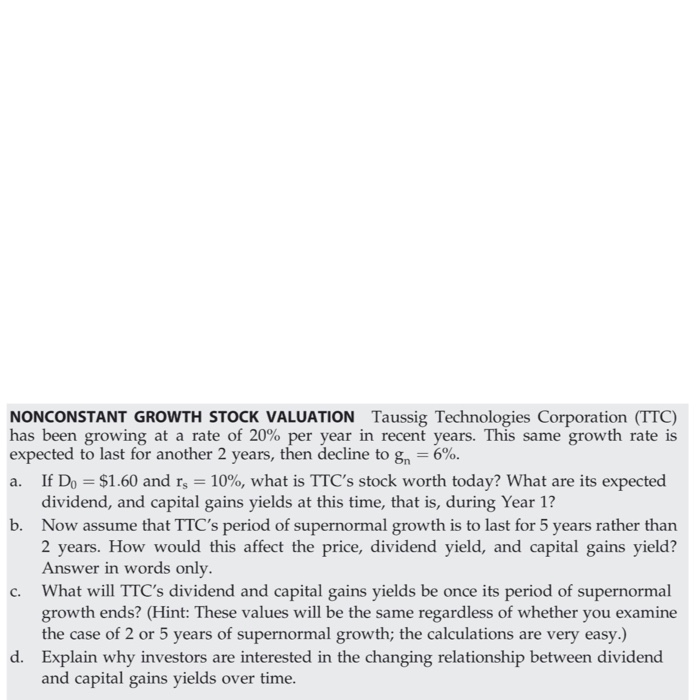

NONCONSTANT GROWTH STOCK VALUATION Taussig Technologies Corporation (TTC) has been growing at a rate of 20% per year in recent years. This same growth rate is expected to last for another 2 years, then decline to gn-6%. a. If Do = $1.60 and rs-10%, what is TTC's stock worth today? What are its expected dividend, and capital gains yields at this time, that is, during Year 1? Now assume that TTC' 2 years. How would this affect the price, dividend yield, and capital gains yield? Answer in words only s period of supernormal growth is to last for 5 years rather than c. What will TTC's dividend and capital gains yields be once its period of supernormal growth ends? (Hint: These values will be the same regardless of whether you examine the case of 2 or 5 years of supernormal growth; the calculations are very easy.) Explain why investors are interested in the changing relationship between dividend and capital gains yields over time. d

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts