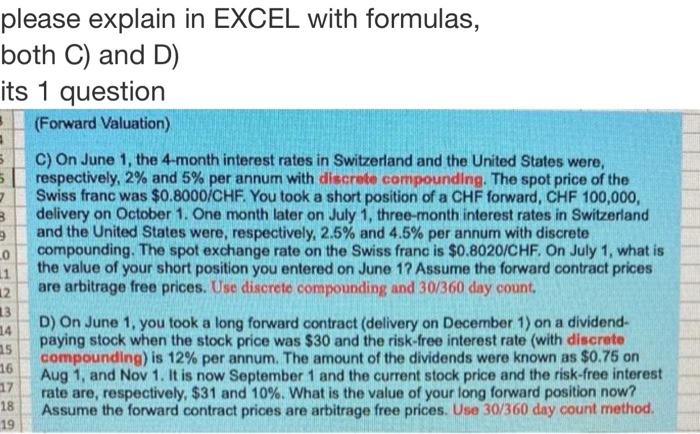

Question: please explain in EXCEL with formulas, both C) and D) its 1 question (Forward Valuation) 5 5 7 3 9 LO 11 12 13 14

please explain in EXCEL with formulas, both C) and D) its 1 question (Forward Valuation) 5 5 7 3 9 LO 11 12 13 14 15 16 17 18 19 C) On June 1, the 4-month interest rates in Switzerland and the United States were, respectively, 2% and 5% per annum with discreto compounding. The spot price of the Swiss franc was $0.8000/CHF You took a short position of a CHF forward, CHF 100,000, delivery on October 1. One month later on July 1, three-month interest rates in Switzerland and the United States were, respectively, 2.5% and 4.5% per annum with discrete compounding. The spot exchange rate on the Swiss franc is $0.8020/CHF. On July 1, what is the value of your short position you entered on June 12 Assume the forward contract prices are arbitrage free prices. Use discrete compounding and 30/360 day count, D) On June 1, you took a long forward contract (delivery on December 1) on a dividend- paying stock when the stock price was $30 and the risk-free interest rate (with discrete compounding) is 12% per annum. The amount of the dividends were known as $0.75 on Aug 1, and Nov 1. It is now September 1 and the current stock price and the risk-free interest rate are, respectively, $31 and 10%. What is the value of your long forward position now? Assume the forward contract prices are arbitrage free prices. Use 30/360 day count method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts