Question: please explain in simplies wasy possible Problem 13-1 Described below are certain transactions of Sarasota Corporation. The company uses the periodic Inventory system, 1. On

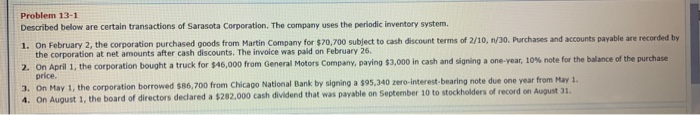

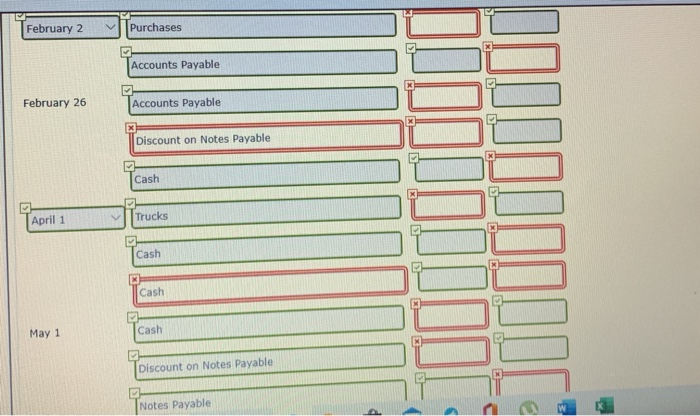

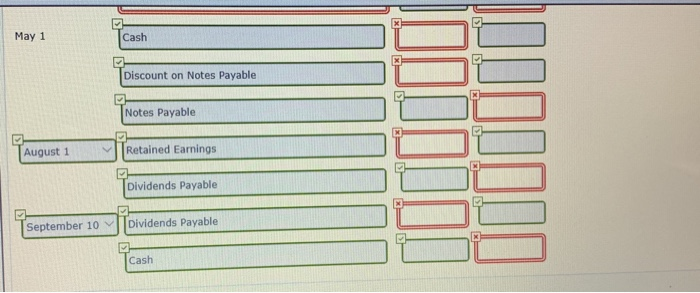

Problem 13-1 Described below are certain transactions of Sarasota Corporation. The company uses the periodic Inventory system, 1. On February 2, the corporation purchased goods from Martin Company for $70,700 subject to cash discount terms of 2/10, 30. Purchases and accounts payable are recorded by the corporation at net amounts after cash discounts. The invoice was paid on February 26. 2. On April 1, the corporation bought a truck for $46,000 from General Motors Company, paying $3,000 in cash and signing a one-year, 10% note for the balance of the purchase price 3. On May 1, the corporation borrowed $86,700 from Chicago National Bank by signing a $95,340 zero-interest bearing note due one year from May 1. 4. On August 1, the board of directors declared a $262.000 cash dividend that was payable on September 10 to stockholders of record on August 31. February 2 Purchases - Accounts Payable February 26 Accounts Payable Discount on Notes Payable Cash DODDOLIDDON April Trucks Cash Cash May 1 Cash Discount on Notes Payable M Notes Payable - A A A D W X May 1 Discount on Notes Payable Notes Payable LODIIDID 100000) August 1 Retained Earnings Dividends Payable September 10 Dividends Payable Cash

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts