Question: Please explain in step wise thankyou Background Information: > Mr. and Mrs. Chan are both 35 years old now. They want to retire at 60

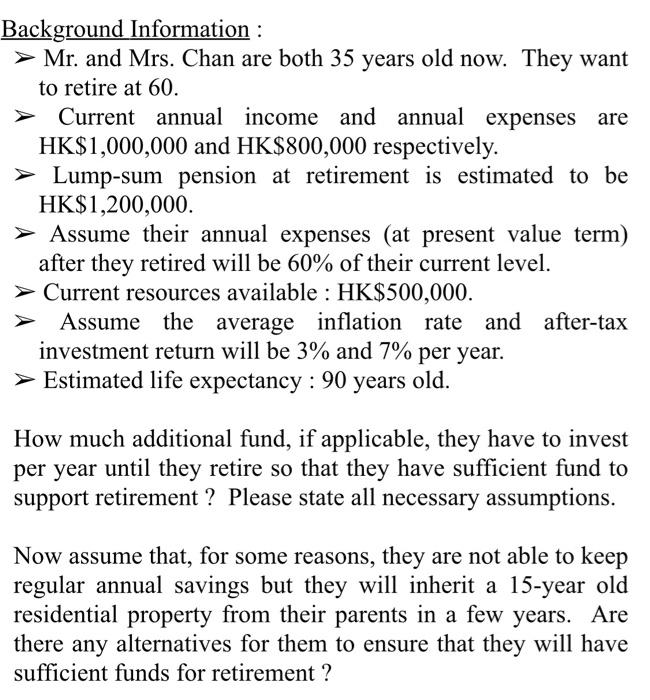

Background Information: > Mr. and Mrs. Chan are both 35 years old now. They want to retire at 60 . > Current annual income and annual expenses are HK$1,000,000 and HK$800,000 respectively. > Lump-sum pension at retirement is estimated to be HK$1,200,000. > Assume their annual expenses (at present value term) after they retired will be 60% of their current level. Current resources available : HK$500,000. > Assume the average inflation rate and after-tax investment return will be 3% and 7% per year. > Estimated life expectancy : 90 years old. How much additional fund, if applicable, they have to invest per year until they retire so that they have sufficient fund to support retirement? Please state all necessary assumptions. Now assume that, for some reasons, they are not able to keep regular annual savings but they will inherit a 15-year old residential property from their parents in a few years. Are there any alternatives for them to ensure that they will have sufficient funds for retirement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts