Question: please explain it in details + what formula you use, thank you A 15-year bond issue with a par value of 1,000 and an annual

please explain it in details + what formula you use, thank you

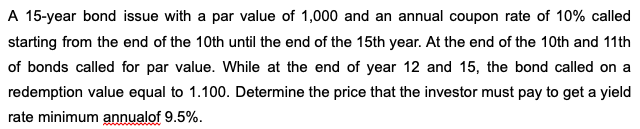

A 15-year bond issue with a par value of 1,000 and an annual coupon rate of 10% called starting from the end of the 10th until the end of the 15th year. At the end of the 10th and 11th of bonds called for par value. While at the end of year 12 and 15, the bond called on a redemption value equal to 1.100. Determine the price that the investor must pay to get a yield rate minimum annualof 9.5%. A 15-year bond issue with a par value of 1,000 and an annual coupon rate of 10% called starting from the end of the 10th until the end of the 15th year. At the end of the 10th and 11th of bonds called for par value. While at the end of year 12 and 15, the bond called on a redemption value equal to 1.100. Determine the price that the investor must pay to get a yield rate minimum annualof 9.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts