Question: Please explain it to me. Im finding this hard to understand. Required information [The following information applies to the questions displayed below.) Laker Company reported

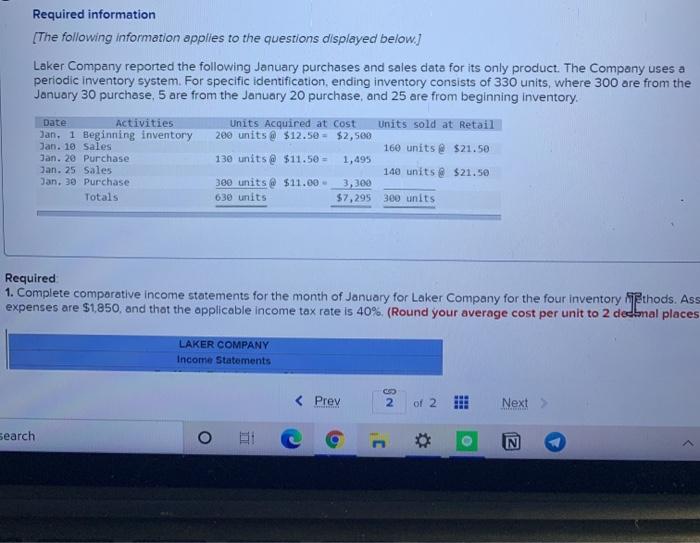

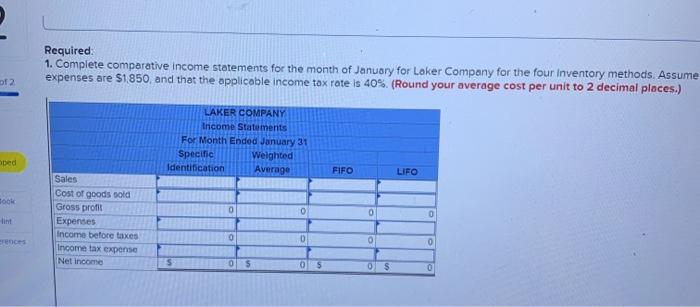

Required information [The following information applies to the questions displayed below.) Laker Company reported the following January purchases and sales data for its only product. The Company uses a periodic Inventory system. For specific identification, ending inventory consists of 330 units, where 300 are from the January 30 purchase, 5 are from the January 20 purchase, and 25 are from beginning inventory. Activities Units Acquired at cost Units sold at Retail Jan. 1 Beginning inventory 200 units @ $12.50 - $2,500 Jan. 10 Sales 160 units @ $21.50 Jan. 20 Purchase 130 units@ $11.50 - 1,495 Jan. 25 Sales 140 units @ $21.50 Jan. 30 Purchase 300 units@ $11.00 3,300 Totals 630 units $7,295 300 units Date Required 1. Complete comparative Income statements for the month of January for Laker Company for the four inventory Mithods. Ass expenses are $1,850, and that the applicable income tax rate is 40% (Round your average cost per unit to 2 de bal places LAKER COMPANY Income Statements

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts