Question: please explain its confusing 1. Ken Builders: Asset Disposition Question: Assume ken Builders has a Dec. 31st year-end and records amortization expense only at the

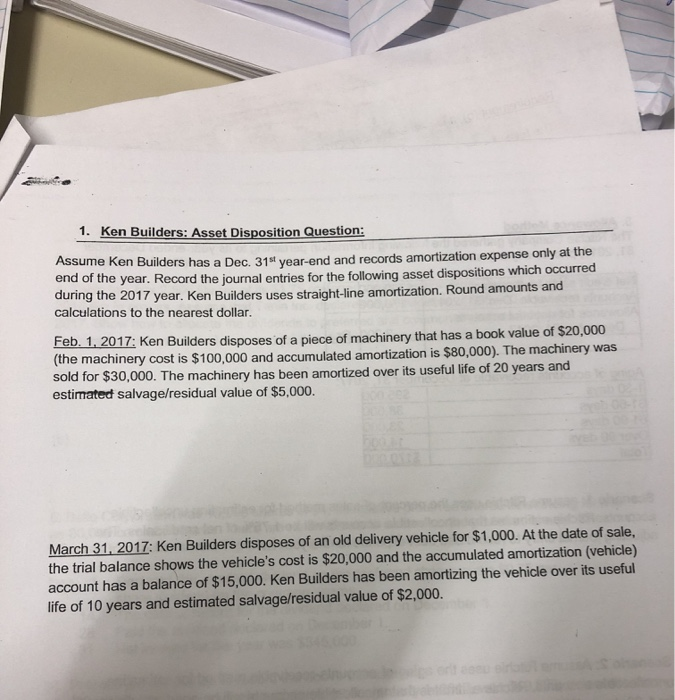

1. Ken Builders: Asset Disposition Question: Assume ken Builders has a Dec. 31st year-end and records amortization expense only at the end of the year. Record the journal entries for the following asset dispositions which occurred during the 2017 year. Ken Builders uses straight-line amortization. Round amounts and calculations to the nearest dollar. Feb. 1. 2017: Ken Builders disposes of a piece of machinery that has a book value of $20,000 (the machinery cost is $100,000 and accumulated amortization is $80,000). The machinery was sold for $30,000. The machinery has been amortized over its useful life of 20 years and estimated salvage/residual value of $5,000. March 31, 2017: Ken Builders disposes of an old delivery vehicle for $1,000. At the date of sale, the trial balance shows the vehicle's cost is $20,000 and the accumulated amortization (vehicle) account has a balance of $15,000. Ken Builders has been amortizing the vehicle over its useful life of 10 years and estimated salvage/residual value of $2,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts