Question: please explain not just answer D Bm has just issued a callabeat par) 5year 97, Coupon bond with quarterly coupon poyments. The bond can be

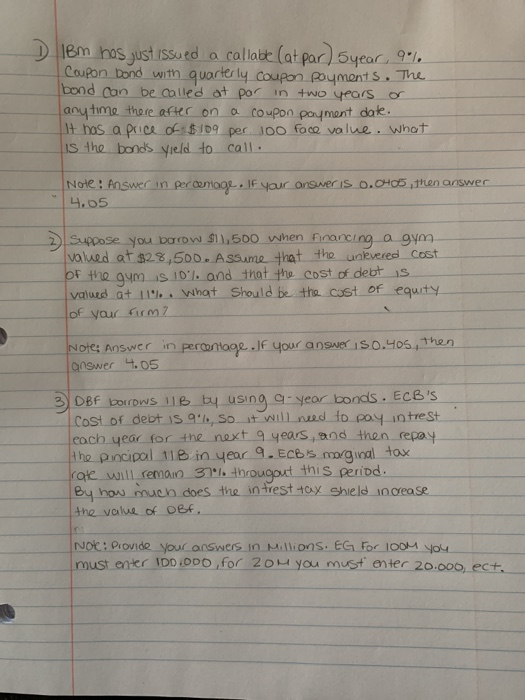

D Bm has just issued a callabeat par) 5year 97, Coupon bond with quarterly coupon poyments. The bond can be called at por in two years or any time there after on a coupon payment date. It has a price of $109 per 100 face value. What is the bonds yield to call. Note: Answer in percentage. If your answer is 0.0405, the answer 4.05 2. Suppose you borrow $1,500 when financing o gym valued at $28,500. Assume that the unlevered cost of the gym is 10'l. and that the cost of debt is valued at 11%. What should be the cost of equity of your firm? Note: Answer in percentage. If your answer is 0.405, then answer 4.05 3) DBF borrows HB by using 9-year bonds. ECB'S Cost of debt is 9., so it will need to pay in trest leach year for the next 9 years, and then repay. the pincipal B in year 9. ECBS morginal tox rake will remain 37. througout this period. By how much does the intrest Hay Shield increase the value of DBf. NOC: Provide your answers in Millions. EG For 100M you! must enter IDD.000,for 2OH you must enter 20.000, ect

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts