Question: please explain not sure and also show working for question 1 thank you Question Not yet saved Marked out of 1.00 The price of a

please explain not sure and also show working for question 1 thank you

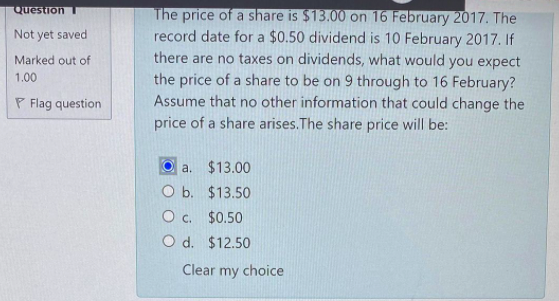

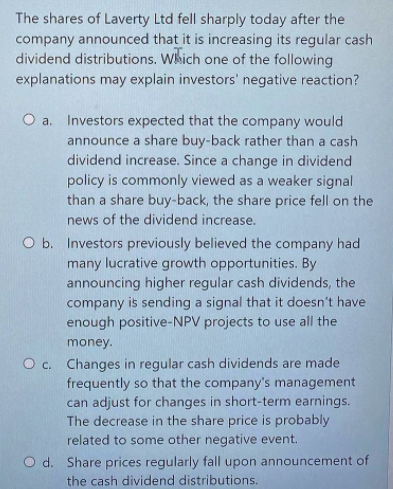

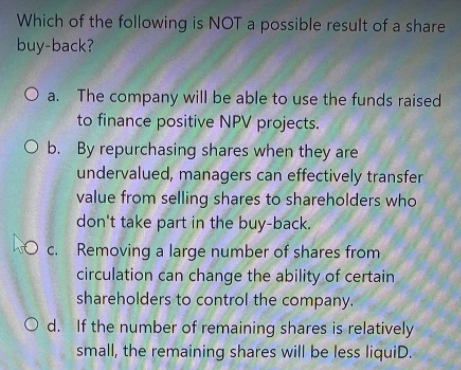

Question Not yet saved Marked out of 1.00 The price of a share is $13.00 on 16 February 2017. The record date for a $0.50 dividend is 10 February 2017. If there are no taxes on dividends, what would you expect the price of a share to be on 9 through to 16 February? Assume that no other information that could change the price of a share arises. The share price will be: P Flag question O a $13.00 O b. $13.50 O c. $0.50 O d. $12.50 Clear my choice The shares of Laverty Ltd fell sharply today after the company announced that it is increasing its regular cash dividend distributions. Which one of the following explanations may explain investors' negative reaction? O a. Investors expected that the company would announce a share buy-back rather than a cash dividend increase. Since a change in dividend policy is commonly viewed as a weaker signal than a share buy-back, the share price fell on the news of the dividend increase. O b. Investors previously believed the company had many lucrative growth opportunities. By announcing higher regular cash dividends, the company is sending a signal that it doesn't have enough positive-NPV projects to use all the money Oc Changes in regular cash dividends are made frequently so that the company's management can adjust for changes in short-term earnings. The decrease in the share price is probably related to some other negative event. O d. Share prices regularly fall upon announcement of the cash dividend distributions. Which of the following is NOT a possible result of a share buy-back? O a. The company will be able to use the funds raised to finance positive NPV projects. O b. By repurchasing shares when they are undervalued, managers can effectively transfer value from selling shares to shareholders who don't take part in the buy-back. ho c. Removing a large number of shares from circulation can change the ability of certain shareholders to control the company. O d. If the number of remaining shares is relatively small, the remaining shares will be less liquid

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts