Question: please explain number 8,9 and 10. Prepare a PR Format income statement, prepare a pro forma balance sheet and prepare a pro forma statement of

please explain number 8,9 and 10. Prepare a PR Format income statement, prepare a pro forma balance sheet and prepare a pro forma statement of cash flows.

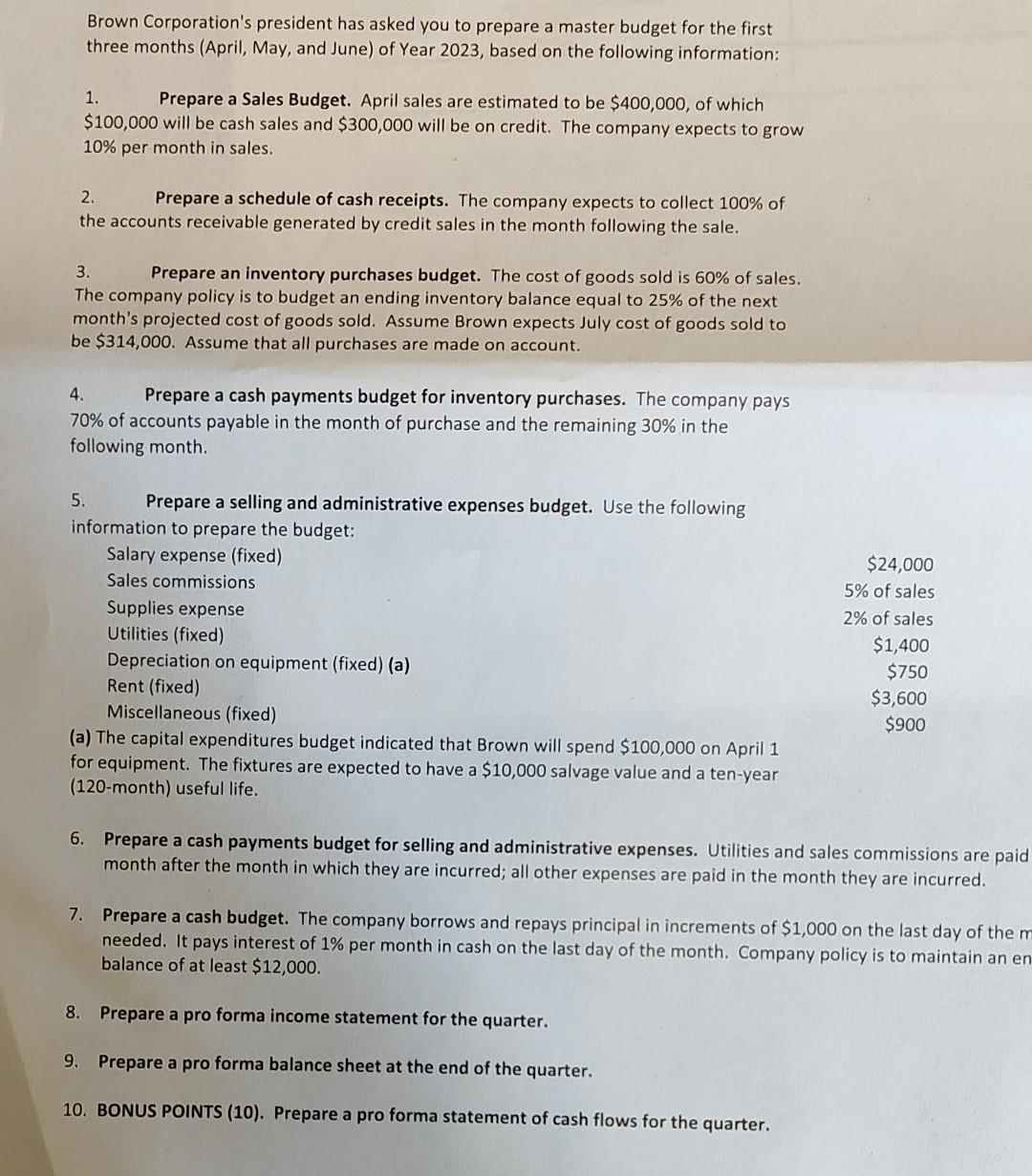

Brown Corporation's president has asked you to prepare a master budget for the first three months (April, May, and June) of Year 2023, based on the following information: 1. Prepare a Sales Budget. April sales are estimated to be $400,000, of which $100,000 will be cash sales and $300,000 will be on credit. The company expects to grow 10% per month in sales. 2. Prepare a schedule of cash receipts. The company expects to collect 100% of the accounts receivable generated by credit sales in the month following the sale. 3. Prepare an inventory purchases budget. The cost of goods sold is 60% of sales. The company policy is to budget an ending inventory balance equal to 25% of the next month's projected cost of goods sold. Assume Brown expects July cost of goods sold to be $314,000. Assume that all purchases are made on account. 4. Prepare a cash payments budget for inventory purchases. The company pays 70% of accounts payable in the month of purchase and the remaining 30% in the following month. for equipment. The fixtures are expected to have a $10,000 salvage value and a ten-year (120-month) useful life. 6. Prepare a cash payments budget for selling and administrative expenses. Utilities and sales commissions are paic month after the month in which they are incurred; all other expenses are paid in the month they are incurred. 7. Prepare a cash budget. The company borrows and repays principal in increments of $1,000 on the last day of the needed. It pays interest of 1% per month in cash on the last day of the month. Company policy is to maintain an e balance of at least $12,000. 8. Prepare a pro forma income statement for the quarter. 9. Prepare a pro forma balance sheet at the end of the quarter. 10. BONUS POINTS (10). Prepare a pro forma statement of cash flows for the quarter. Brown Corporation's president has asked you to prepare a master budget for the first three months (April, May, and June) of Year 2023, based on the following information: 1. Prepare a Sales Budget. April sales are estimated to be $400,000, of which $100,000 will be cash sales and $300,000 will be on credit. The company expects to grow 10% per month in sales. 2. Prepare a schedule of cash receipts. The company expects to collect 100% of the accounts receivable generated by credit sales in the month following the sale. 3. Prepare an inventory purchases budget. The cost of goods sold is 60% of sales. The company policy is to budget an ending inventory balance equal to 25% of the next month's projected cost of goods sold. Assume Brown expects July cost of goods sold to be $314,000. Assume that all purchases are made on account. 4. Prepare a cash payments budget for inventory purchases. The company pays 70% of accounts payable in the month of purchase and the remaining 30% in the following month. for equipment. The fixtures are expected to have a $10,000 salvage value and a ten-year (120-month) useful life. 6. Prepare a cash payments budget for selling and administrative expenses. Utilities and sales commissions are paic month after the month in which they are incurred; all other expenses are paid in the month they are incurred. 7. Prepare a cash budget. The company borrows and repays principal in increments of $1,000 on the last day of the needed. It pays interest of 1% per month in cash on the last day of the month. Company policy is to maintain an e balance of at least $12,000. 8. Prepare a pro forma income statement for the quarter. 9. Prepare a pro forma balance sheet at the end of the quarter. 10. BONUS POINTS (10). Prepare a pro forma statement of cash flows for the quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts