Question: Please explain on how to do this equation on a financial calculator !! Step by Step !! Considering the following information, what is the NPV

Please explain on how to do this equation on a financial calculator !! Step by Step !!

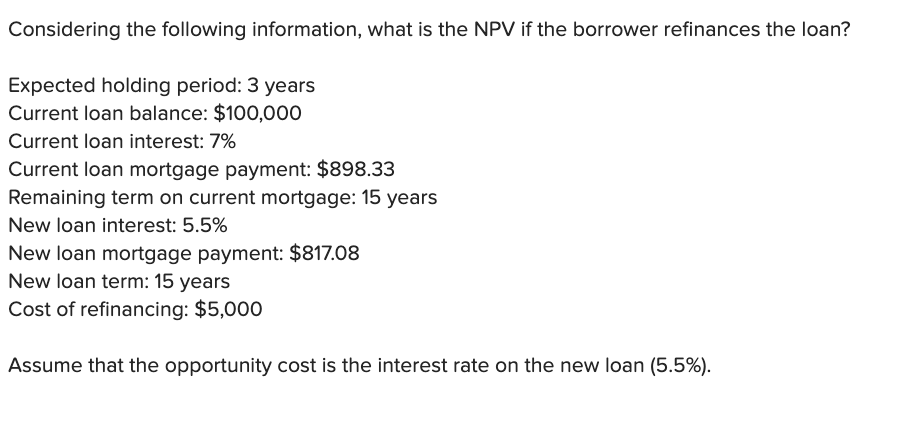

Considering the following information, what is the NPV if the borrower refinances the loan? Expected holding period: 3 years Current loan balance: $100,000 Current loan interest: 7% Current loan mortgage payment: $898.33 Remaining term on current mortgage: 15 years New loan interest: 5.5% New loan mortgage payment: $817.08 New loan term: 15 years Cost of refinancing: $5,000 Assume that the opportunity cost is the interest rate on the new loan (5.5%). Considering the following information, what is the NPV if the borrower refinances the loan? Expected holding period: 3 years Current loan balance: $100,000 Current loan interest: 7% Current loan mortgage payment: $898.33 Remaining term on current mortgage: 15 years New loan interest: 5.5% New loan mortgage payment: $817.08 New loan term: 15 years Cost of refinancing: $5,000 Assume that the opportunity cost is the interest rate on the new loan (5.5%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts