Question: Please explain or show calculation lark Industries has 200 mln shares outstanding, a current share price of $30, and no debt. Clark's management believes that

Please explain or show calculation

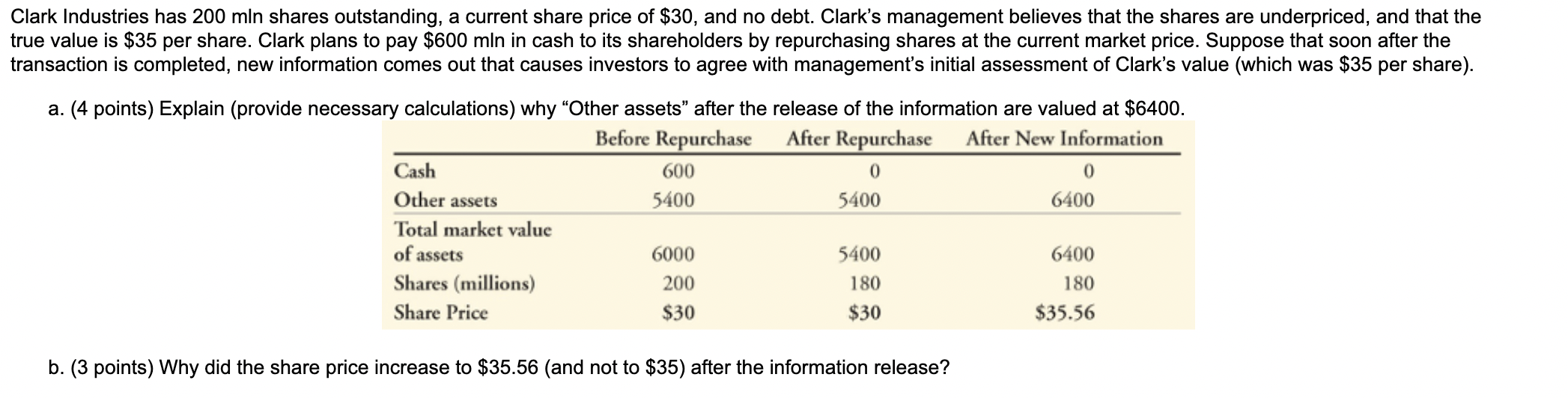

lark Industries has 200 mln shares outstanding, a current share price of $30, and no debt. Clark's management believes that the shares are underpriced, and that the ue value is $35 per share. Clark plans to pay $600mln in cash to its shareholders by repurchasing shares at the current market price. Suppose that soon after the ansaction is completed, new information comes out that causes investors to agree with management's initial assessment of Clark's value (which was $35 per share). a. (4 points) Explain (provide necessary calculations) why "Other assets" after the release of the information are valued at $6400. b. (3 points) Why did the share price increase to $35.56 (and not to $35 ) after the information release

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts