Question: please explain or show work, i have tried these problems several times, and cant figure out what i am doing wrong i cant get the

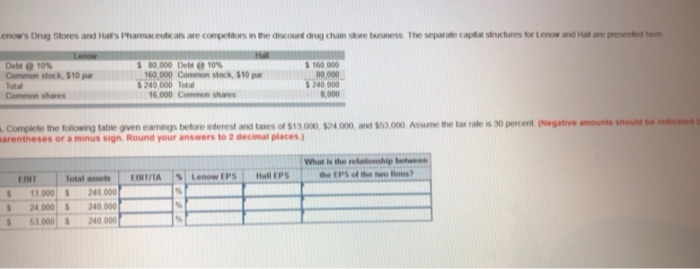

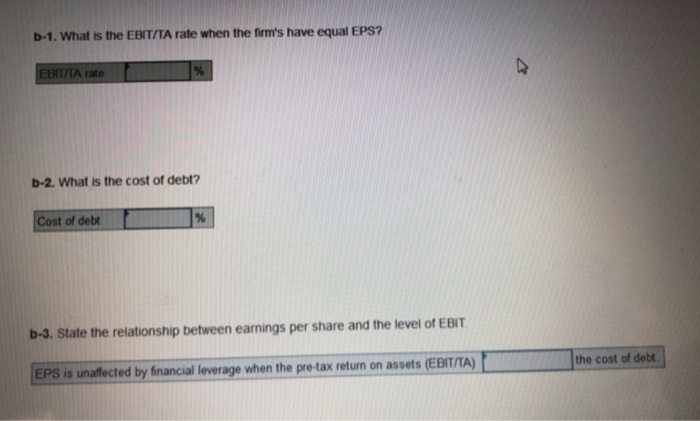

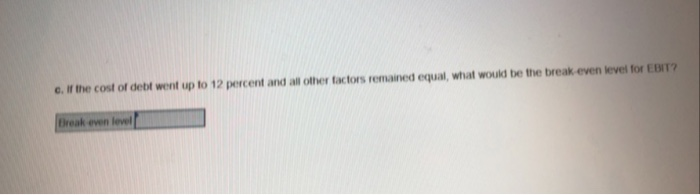

enow's Drug Stores and Hall's Pharmaceuticals are competitors in the discount drug chain store busaness The separate captal structures for Lenow and Hall are presented here Lenow Hal $ 80,000 Debte 10% 160.000 Common stock, $10 par $ 240,000 Total 16,000 Common shares $ 160 000 8 000 $ 240 000 8,000 Debt @ 10% Common stock, $10 par Total Common shares , Complete the following table given eamings before interest and tases of $13 000, $24 000 and $53,000 Assume the tax rate is 30 percent (Negative amounts should be indicated arentheses or a minus sign. Round your answers to 2 decimal places What is the relationship between the EPS of the we lis Hall EPS Lenow EPS Total assets EBIT/TA 240 000 13.000 24.000 240 000 63.000 240 000 b-1. What is the EBIT/TA rate when the firm's have equal EPS? EBIT/TA rate b-2. What is the cost of debt? Cost of debt b-3. State the relationship between earnings per share and the level of EBIT the cost of debt EPS is unaffected by financial leverage when the pre-tax return on assets (EBIT/TA) c. If the cost of debf went up to 12 percent and all other factors remained equal, what would be the break-even level for EBIT Break even level

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts