Question: please explain Problem: Module 9 Textbook Problem 9 Learning Objective: 9-6 Explain why individuals once again can use corporations as tax shelters. Megan operates a

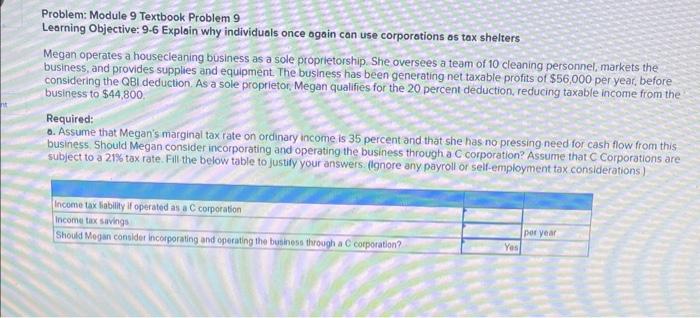

Problem: Module 9 Textbook Problem 9 Learning Objective: 9-6 Explain why individuals once again can use corporations as tax shelters. Megan operates a housecleaning business as a sole proprletorship. She oversees a team of 10 cleaning personnel, markets the business, and provides supplies and equipment. The business has been generating net taxable profits of $56,000 per year, before considering the QBI deduction. As a sole proprietor, Megan qualifies for the 20 percent deduction, reducing taxable income from the business to $44,800 Required: o. Assume that Megan's marginal tax rate on ordinary income is 35 percent and that she has no pressing need for cash flow from this business. Should Megan consider incorporating and operating the business through a C corporation? Assume that C Corporations are subject to a 218 tax rate. Fill the below table to justify your answers. (lgnore any payroll or self-employment tax considerations)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts