Question: Please explain Qs 5 , 6 and 8 using BAII plus if possible or give me the formula to solve these problems Thanks Thames Inc.'s

Please explain Qs 5 , 6 and 8 using BAII plus if possible or give me the formula to solve these problems Thanks

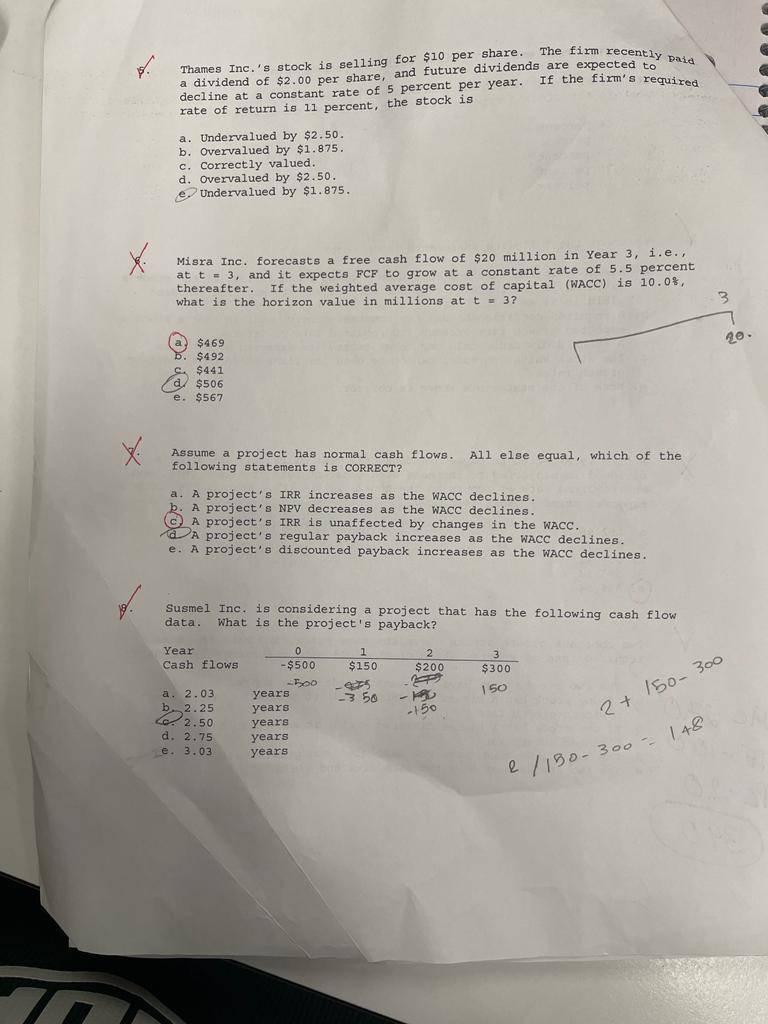

Thames Inc.'s stock is selling for $10 per share. The firm recently paid a dividend of $2.00 per share, and future dividends are expected to decline at a constant rate of 5 percent per year. If the firm's required rate of return is 11 percent, the stock is a. Undervalued by $2.50. b. Overvalued by $1.875. c. Correctly valued. d. overvalued by $2.50. e. Undervalued by $1.875. Misra Inc. forecasts a free cash flow of $20million in Year 3 , i.e., at t=3, and it expects FCF to grow at a constant rate of 5.5 percent thereafter. If the weighted average cost of capital (WACC) is 10.08, what is the horizon value in millions at t=3 ? (a) $469 D. $492 C. $441 d. $506 e. $567 Assume a project has normal cash flows. All else equal, which of the following statements is CORRECT? a. A project's IRR increases as the WACC declines. b. A project's NPV decreases as the WACC declines. (c) A project's IRR is unaffected by changes in the WACC. d. A project's regular payback increases as the WACC declines. e. A project's discounted payback increases as the WACC declines. Susmel Inc. is considering a project that has the following cash flow data. What is the project's payback

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts