Question: please explain Question 20 4 pts You are given the following exchange rates: Spot rate USD1.9618 / GBP CAD 1.1145 / USD MXN 10.4943 /

please explain

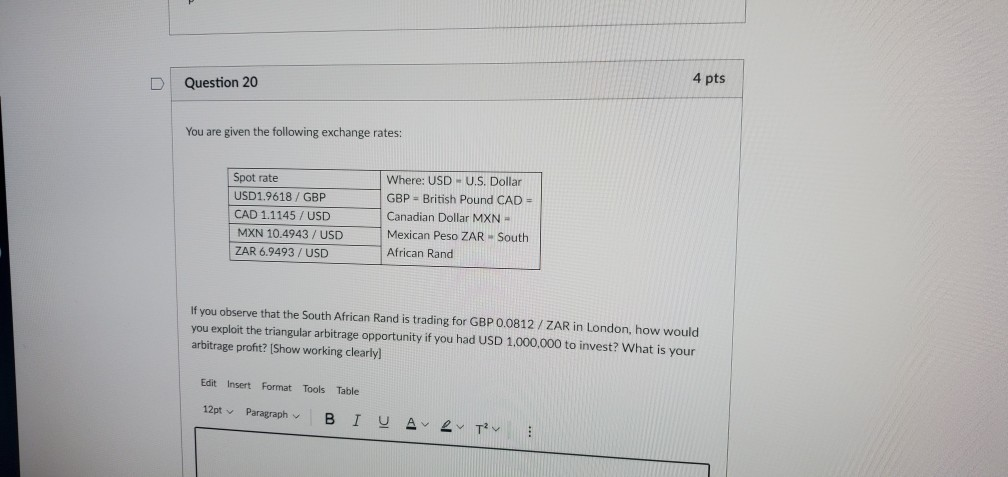

Question 20 4 pts You are given the following exchange rates: Spot rate USD1.9618 / GBP CAD 1.1145 / USD MXN 10.4943 / USD ZAR 6.9493 / USD Where: USD - U.S. Dollar GBP - British Pound CAD = Canadian Dollar MXN - Mexican Peso ZAR - South African Rand If you observe that the South African Rand is trading for GBP 0.0812 / ZAR in London, how would you exploit the triangular arbitrage opportunity if you had USD 1,000,000 to invest? What is your arbitrage profit? (Show working clearly Edit Insert Format Tools Table 12pt Paragraph B I U AT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts