Question: Please explain question b and c. Thank you so much Consider a duopoly market, where two firms sell differentiated prod- ucts, which are imperfect substitutes.

Please explain question b and c. Thank you so much

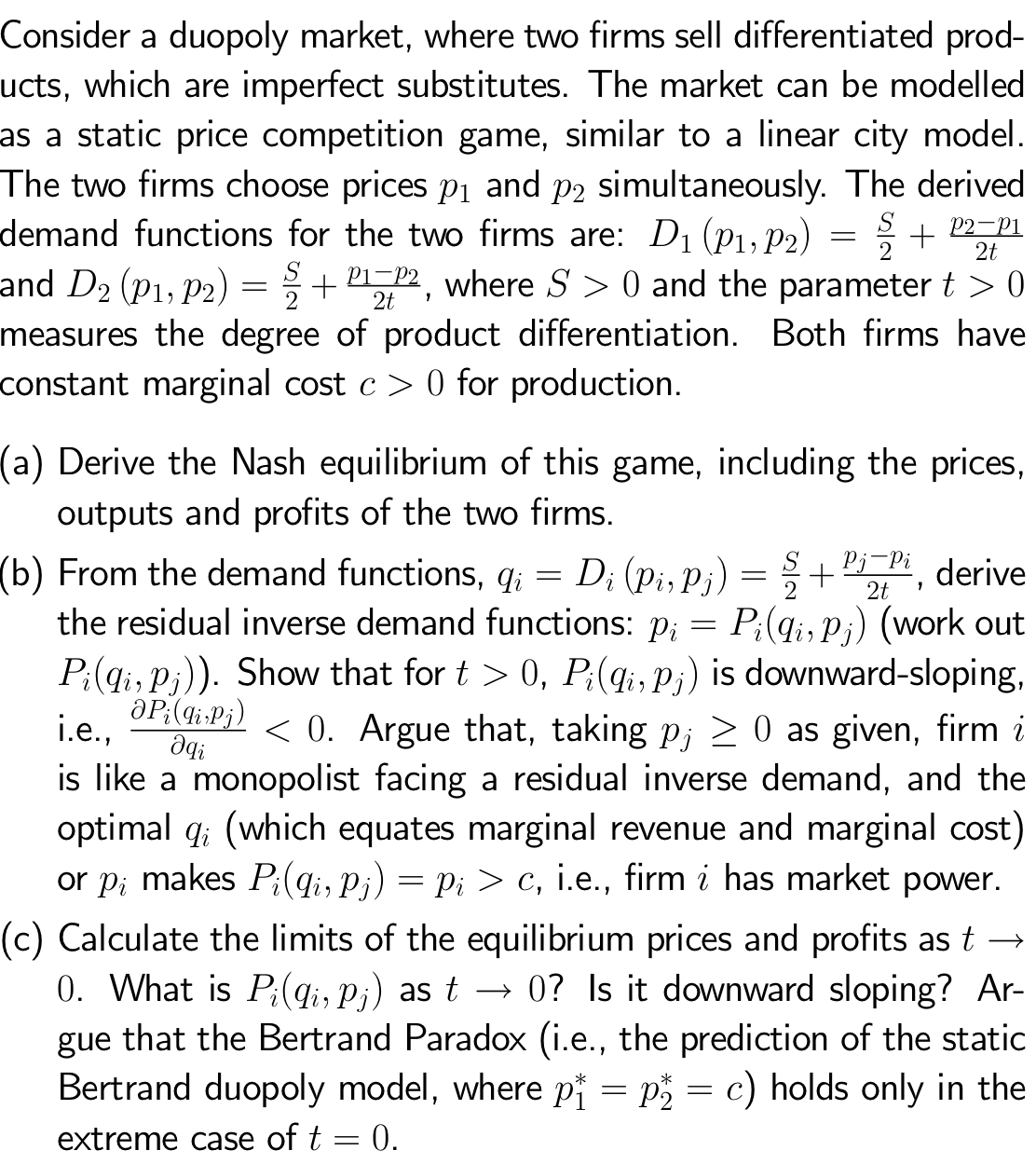

Consider a duopoly market, where two firms sell differentiated prod- ucts, which are imperfect substitutes. The market can be modelled as a static price competition game, similar to a linear city model. The two firms choose prices p1 and p2 simultaneously. The derived demand functions for the two firms are: D1 (291,132) = g + 21111 and D2 (331,132) 2 + 3%, where S > 0 and the parameter t > 0 measures the degree of product differentiation. Both firms have constant marginal cost 0 > O for production. (a) Derive the Nash equilibrium of this game, including the prices, outputs and profits of the two firms. (b) From the demand functions, q,- = D,- (p,,pj) = %+ ijtp, derive the residual inverse demand functions: p,- = P,(q,,pj) (work out P,(q,-,pj)). Show that for t > 0, H;(q,-,pj) is downward-sloping, i.e., 8&5???\" 0 as given, firm '23 is like a monopolist facing a residual inverse demand, and the optimal g,- (which equates marginal revenue and marginal cost) or p,- makes P,(q,,pj) = p,- > C, Le, firm 2' has market power. (c) Calculate the limits of the equilibrium prices and profits as t > 0. What is P,(q,,pj) as t > 0? Is it downward sloping? Ar- gue that the Bertrand Paradox (i.e., the prediction of the static Bertrand duopoly model, where 291' = p; = 0) holds only in the extreme case of t = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts