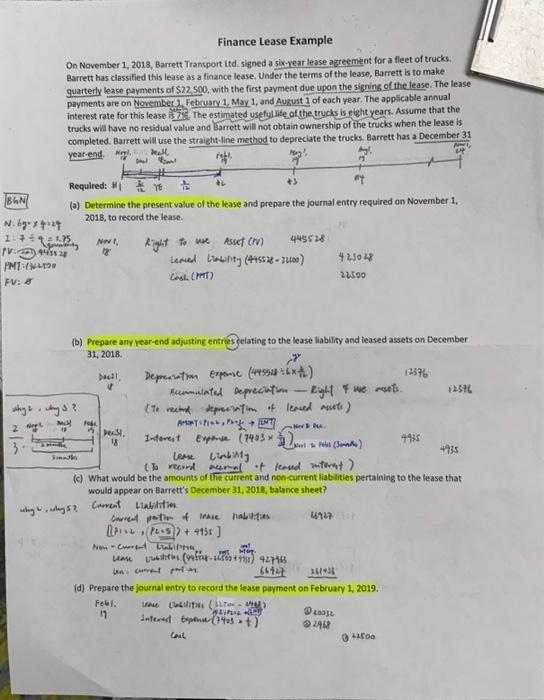

Question: Please explain Question (c), why the calculation of current portion of lease liability is P1=2, P2=5. Thank you. On November 1, 2018, Barrett Transport itd.

On November 1, 2018, Barrett Transport itd. signed a sik-vear lease agreement for a fleet of trucks. Barrett has classified this lease as a finance lease. Under the terms of the lease, Barrett is to make quarterly lease payments of $22,500, with the first payment due upon the signing of the lease. The lease payments are on Nonember 1. February 1, May 1, and August 1 of each year. The applicable annual interest rate for this lease is 75 . The estimated usefylife of the trucks is eight years. Assume that the trucks will have no residual value and Barrett will not obtain ownership of the trucks when the lease is comoleted. Barrett will use the straikht line method to depreciate the trucks. Barrett has a December 31 ye: Re (a) Determine the present value of the lease and prepare the journal entry required on November 1 , 2018 , to record the lease. Nori, Right to we Asset (NV) 445528 Cosh. ( rmt) 22500 (b) Prepare any year-end adjusting entresfelating to the lease llability and leased assets on December 31,2018. 12376 fammated deprecinton - Ryd f we resots. 12316 (7. reend deperiafim of leased anset) leme Linbinty 4 35 (c) What would be the amounts of the current and non-current liablith would appear on Barrett's December 31,2018 , batance sheet? ons? Cervent thabition. uni curct prim. 66427 3u+s! (d) Prepare the journal entry to record the lease payment on February 1, 2019

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts