Question: please explain round 5 capstone financial statistic only Baldwin company. why this % is this or how can we improve in next round.Aslo, you can

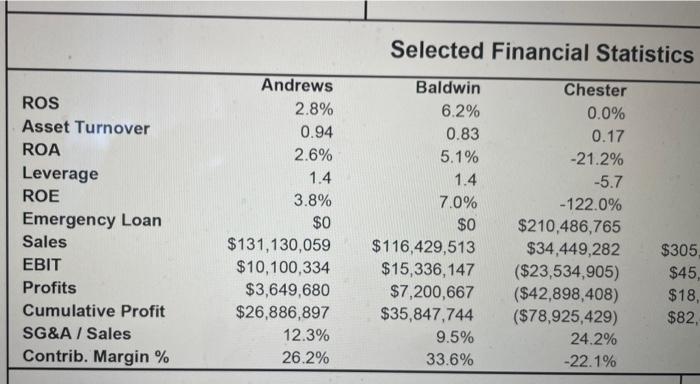

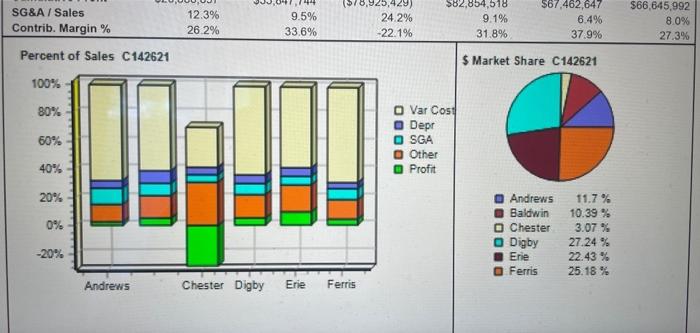

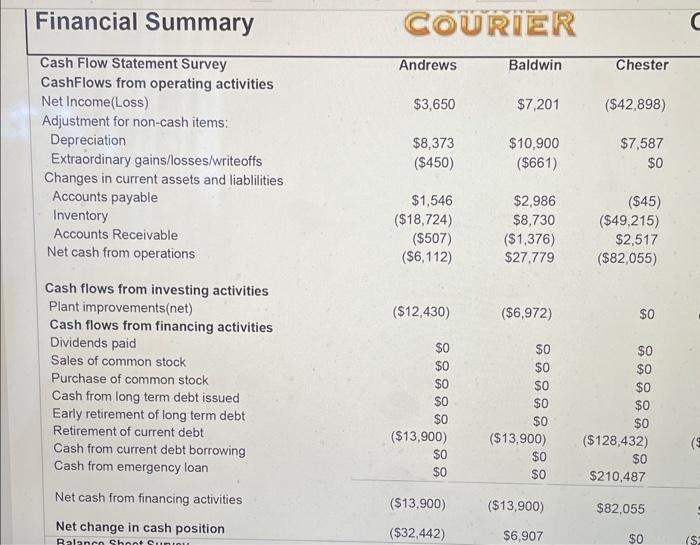

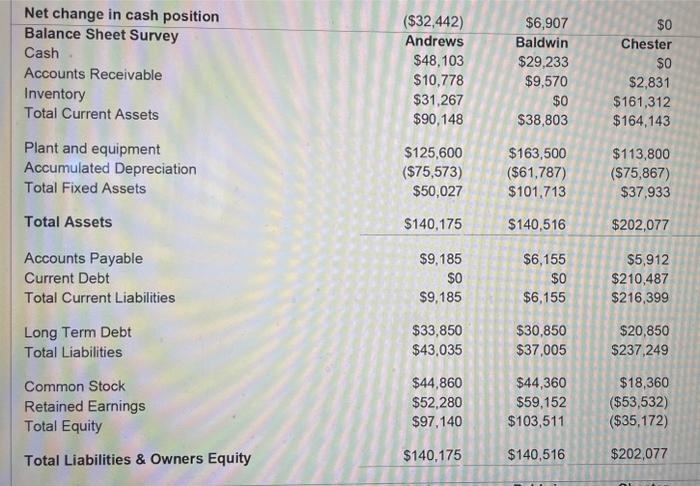

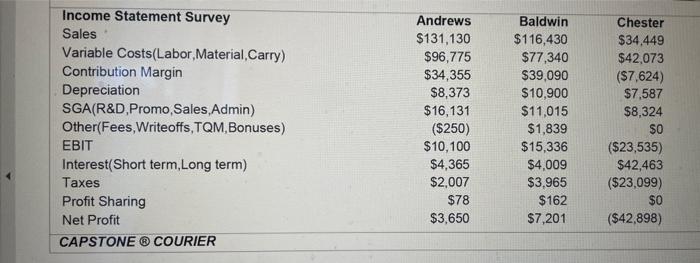

Selected Financial Statistics $ Market Share C142621 Financial Summary \begin{tabular}{lrrr} \hline Cash Flow Statement Survey & Andrews & Baldwin & Chester \\ CashFlows from operating activities & & & \\ Net Income(Loss) & $3,650 & $7,201 & ($42,898) \\ Adjustmentfornon-cashitems:Depreciation & $8,373 & $10,900 & $7,587 \\ Extraordinary gains/losses/writeoffs & ($450) & ($661) & $0 \\ Changes in current assets and liablilities & & & \\ Accounts payable & $1,546 & $2,986 & ($45) \\ Inventory & ($18,724) & $8,730 & ($49,215) \\ Accounts Receivable & ($507) & ($1,376) & $2,517 \\ Net cash from operations & ($6,112) & $27,779 & ($82,055) \end{tabular} Cash flows from investing activities Plant improvements(net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan Net cash from financing activities Net change in cash position ($12,430)$0$0$0$0$0($13,900)$0$0($13,900)($32,442)($6,972)$0$0$0$0$0($13,900)$0$0($13,900)$6,907$0$0$0$0$0$0($128,432)$0$210,487$82,055$0 \begin{tabular}{lrrr} Income Statement Survey & Andrews & Baldwin & \multicolumn{1}{c}{ Chester } \\ Sales & $131,130 & $116,430 & $34,449 \\ Variable Costs(Labor,Material,Carry) & $96,775 & $77,340 & $42,073 \\ Contribution Margin & $34,355 & $39,090 & ($7,624) \\ Depreciation & $8,373 & $10,900 & $7,587 \\ SGA(R\&D,Promo,Sales,Admin) & $16,131 & $11,015 & $8,324 \\ Other(Fees,Writeoffs,TQM,Bonuses) & ($250) & $1,839 & $0 \\ EBIT & $10,100 & $15,336 & ($23,535) \\ Interest(Short term,Long term) & $4,365 & $4,009 & $42,463 \\ Taxes & $2,007 & $3,965 & ($23,099) \\ Profit Sharing & $78 & $162 & $0 \\ Net Profit & $3,650 & $7,201 & ($42,898) \end{tabular} CAPSTONE @COURIER Selected Financial Statistics $ Market Share C142621 Financial Summary \begin{tabular}{lrrr} \hline Cash Flow Statement Survey & Andrews & Baldwin & Chester \\ CashFlows from operating activities & & & \\ Net Income(Loss) & $3,650 & $7,201 & ($42,898) \\ Adjustmentfornon-cashitems:Depreciation & $8,373 & $10,900 & $7,587 \\ Extraordinary gains/losses/writeoffs & ($450) & ($661) & $0 \\ Changes in current assets and liablilities & & & \\ Accounts payable & $1,546 & $2,986 & ($45) \\ Inventory & ($18,724) & $8,730 & ($49,215) \\ Accounts Receivable & ($507) & ($1,376) & $2,517 \\ Net cash from operations & ($6,112) & $27,779 & ($82,055) \end{tabular} Cash flows from investing activities Plant improvements(net) Cash flows from financing activities Dividends paid Sales of common stock Purchase of common stock Cash from long term debt issued Early retirement of long term debt Retirement of current debt Cash from current debt borrowing Cash from emergency loan Net cash from financing activities Net change in cash position ($12,430)$0$0$0$0$0($13,900)$0$0($13,900)($32,442)($6,972)$0$0$0$0$0($13,900)$0$0($13,900)$6,907$0$0$0$0$0$0($128,432)$0$210,487$82,055$0 \begin{tabular}{lrrr} Income Statement Survey & Andrews & Baldwin & \multicolumn{1}{c}{ Chester } \\ Sales & $131,130 & $116,430 & $34,449 \\ Variable Costs(Labor,Material,Carry) & $96,775 & $77,340 & $42,073 \\ Contribution Margin & $34,355 & $39,090 & ($7,624) \\ Depreciation & $8,373 & $10,900 & $7,587 \\ SGA(R\&D,Promo,Sales,Admin) & $16,131 & $11,015 & $8,324 \\ Other(Fees,Writeoffs,TQM,Bonuses) & ($250) & $1,839 & $0 \\ EBIT & $10,100 & $15,336 & ($23,535) \\ Interest(Short term,Long term) & $4,365 & $4,009 & $42,463 \\ Taxes & $2,007 & $3,965 & ($23,099) \\ Profit Sharing & $78 & $162 & $0 \\ Net Profit & $3,650 & $7,201 & ($42,898) \end{tabular} CAPSTONE @COURIER

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts