Question: Please explain solution step by step. Thanks! P 12-8 (similar to) Question Help Stocks A and B have the following returns: 1 2 3 4

Please explain solution step by step. Thanks!

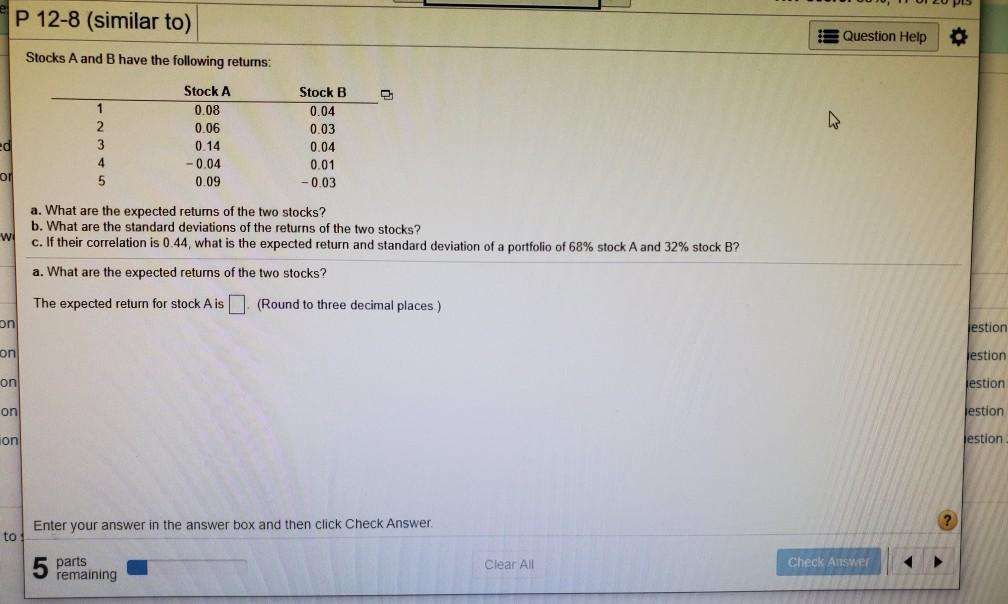

P 12-8 (similar to) Question Help Stocks A and B have the following returns: 1 2 3 4 Stock A 0.08 0.06 0.14 -0.04 0.09 Stock B 0.04 0.03 0.04 0.01 -0.03 ed or 5 a. What are the expected returns of the two stocks? b. What are the standard deviations of the returns of the two stocks? c. If their correlation is 0.44, what is the expected return and standard deviation of a portfolio of 68% stock A and 32% stock B? a. What are the expected returns of the two stocks? The expected return for stock Ais (Round to three decimal places) on jestion on estion on Jestion on estion lon estion Enter your answer in the answer box and then click Check Answer ? to 5 panta Clear All Check Answer remaining

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to calculate the expected returns for Stocks A and B the standard deviations of their returns and the portfolio statistics Lets break it down step by step Part a Expected ... View full answer

Get step-by-step solutions from verified subject matter experts