Question: Please explain step by step and round your final answerto 4 decimal places. Question 2 Uder Inc. is considering the possibility of refunding its $320

Please explain step by step and round your final answerto 4 decimal places.

Please explain step by step and round your final answerto 4 decimal places.

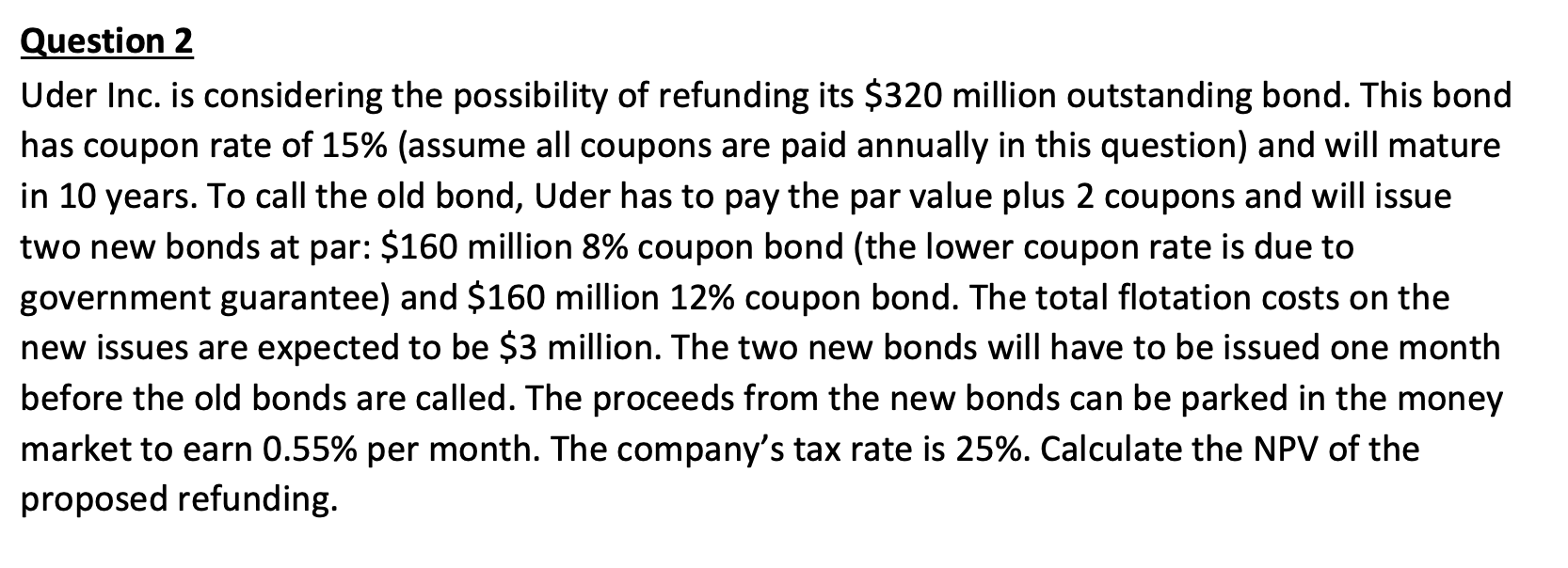

Question 2 Uder Inc. is considering the possibility of refunding its $320 million outstanding bond. This bond has coupon rate of 15% (assume all coupons are paid annually in this question) and will mature in 10 years. To call the old bond, Uder has to pay the par value plus 2 coupons and will issue two new bonds at par: $160 million 8% coupon bond (the lower coupon rate is due to government guarantee) and $160 million 12% coupon bond. The total flotation costs on the new issues are expected to be $3 million. The two new bonds will have to be issued one month before the old bonds are called. The proceeds from the new bonds can be parked in the money market to earn 0.55% per month. The company's tax rate is 25%. Calculate the NPV of the proposed refunding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts