Question: please explain step by step Ch. 9 Transaction Exposure - Exercise II Ottumwa Tech Inc. (OTI) has just signed a contract to purchase high tech

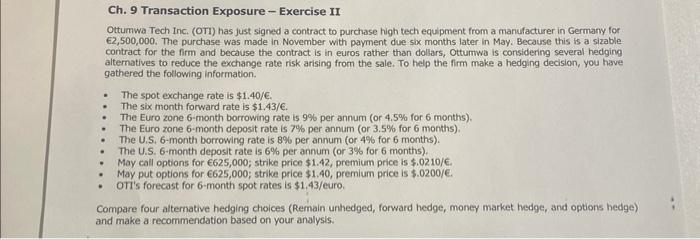

Ch. 9 Transaction Exposure - Exercise II Ottumwa Tech Inc. (OTI) has just signed a contract to purchase high tech equipment from a manufacturer in Germany for 2,500,000. The purchase was made in November with payment due six months later in May. Because this is a sizable contract for the firm and because the contract is in euros rather than dollars, Otturmwa is considering several hedging alternatives to reduce the exchange rate risk arising from the sale. To help the firm make a hedging decision, you have gathered the following information. - The spot exchange rate is $1.40/. - The six month forward rate is $1,43/. - The Euro zone 6 -month borrowing rate is 9% per annum (or 4.5% for 6 months). - The Euro zone 6 -month deposit rate is 7% per annum (or 3.5% for 6 months). - The U.S. 6 -month borrowing rate is 8% per annum (or 4% for 6 months). - The U.S. 6 -month deposit rate is 6% per annum (or 3% for 6 months). - May call options for 625,000; strike price $1.42, premium price is $.0210/. - May put options for 6625,000 ; strike price $1.40, premium price is $.0200/. - OTi's forecast for 6 -month spot rates is $1,43/ euro. Compare four alternative hedging choices (Remain unhedged, forward hedge, money market hedge, and options hedge) and make a recommendation based on your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts