Question: please explain step by step, don't just give the answers. explain step by step with formulas please Troy Enpines, Limhed, mamfactures a variety of engines

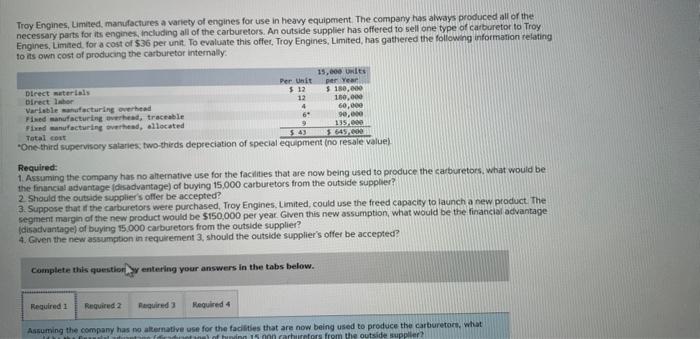

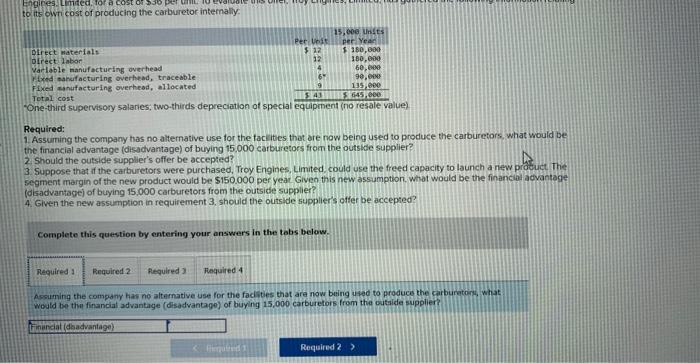

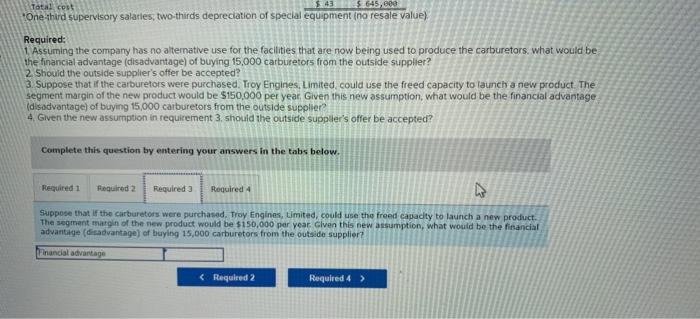

Troy Enpines, Limhed, mamfactures a variety of engines for use in heavy equipment. The compary has always produced all of the necessary parts for its engines, including all of the carburetors. An outside supplier has offered to sell one type of carburetor to Troy Engines, Limited for a cost of $36 per unit. To evaluate this offec, Troy Engines, Limited, has gathered the following information relating to as own cost of producang the carburetor internally: Required: 1. Assuming the company has no altemative use for the facilities that are now being used to produce the caiburetors, what would be the financial advantage (disadvantage) of buying 15,000 carburetors from the outside suppler? 2. Should the outside supplier's offer be accepted? 3. Suppose that it the carburetors were purchased, Troy Engines. Limited, could use the freed capacity to launch a new product. The segment margin of the new product would be $150,000 per year. Given this new assumption, what would be the financial advantage laisattuartagel of buying 15,000 carbutetors from the outside supplier? 4. Given the new assumption in tequkement 3, should the outside supplier's offer be accepted? Complete this questior Wy entering your answers in the tabs below. Assuming the company has no aitemative use for the facililes that are now being used to produce the carburetor.. nhat Required: 1. Assuming the company has no alternative use for the tac itbes that are now being used to produce the carburetors, what would be: the financial advantage (disadvantage) of buying 15.000 carburetors from the outside supplier? 2 Should the outside supplier's offer be accepted? 3. Suppose that if the carburetors were purchased, Troy Engines, Limited could use the freed capacity to launch a newew procuct. The segment margin of the new product would be $150.000 per yeat Given this new assumption. What would be the financia adovantone (disadvantage) of buying 15,000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3, should the outside supplier's otter be accepted? Complete this question by entering your answers in the tobs below. Assuming the company has no alternative use for the facisties that are now being uaed to produce the carburatoind, what would be they financiat advantage (disadvantage) of buying 15,000 carburetors from the cutaide supplier? Total cos? "One-hird supervisary salarles, two-thirds depreciation of special equipment (no fesale value) Rectuired: 1. Assuming the comparty has no a temative use for the facilities that are now being used to produce the carburetors. what would be the financial advantage (disadvantage) of buying 15,000 carburetors from the outside supplier? 2 Shouid the outside supplier's offer be accepted? 3. Suppose that if the carburetors were purchased. Troy Engines, Limited could use the freed capacity to launch a new product. The segment margin of the new product would be 5150,000 per year. Given this new assumption, what would be the financial advantage (disodvantage) of buying 15,000 carburetors from the outside supplier? 4. Given the new assumption in requirement 3 , should the outside suppler's offer be accepted? Coumplete this question by entering your answers in the tabs below. Sippose that if the carburetors were purchated. Troy Engines, timited, could use the freed capacity to launch a new product. The segmant matgin of the new product would be $150,000 per year. Glven this new assumption, what would be the financial advantitge (disadvantage) of buying 15,000 carburetors from the outside supplier

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts