Question: please explain step by step EXERCISE 2-7 Equivalent units of production Objectives 2, 3 o. Conversion 173,333 the Drawing Department and (b) the Winding Department.

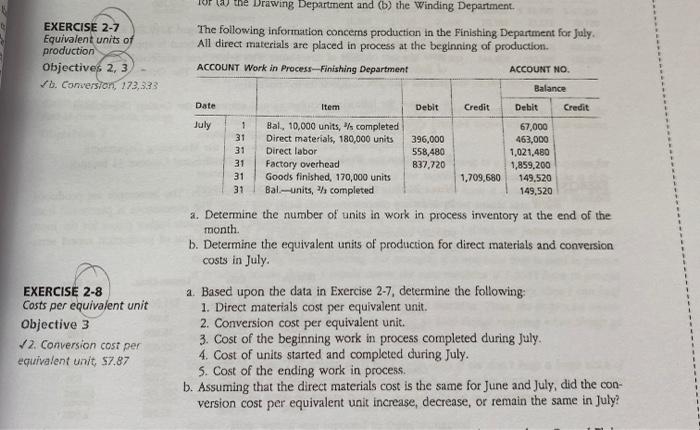

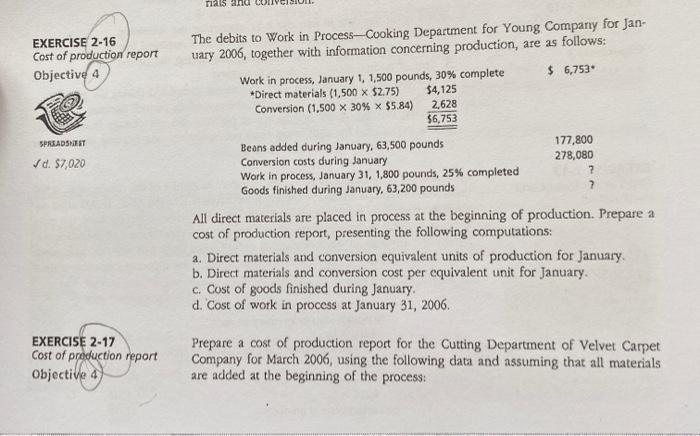

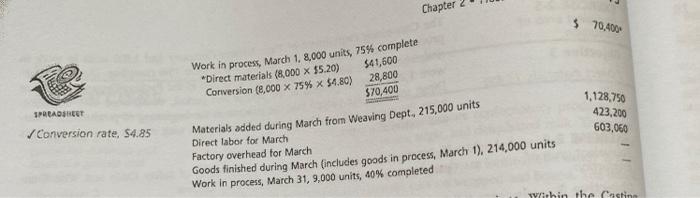

EXERCISE 2-7 Equivalent units of production Objectives 2, 3 o. Conversion 173,333 the Drawing Department and (b) the Winding Department. The following information concerns production in the Finishing Department for July All direct materials are placed in process at the beginning of production ACCOUNT Work in Process-Finishing Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit July 1 Bal., 10,000 units, completed 67,000 31 Direct materials, 180,000 units 396,000 463,000 31 Direct labor 558,480 1,021,480 31 Factory overhead 837,720 1,859,200 31 Goods finished, 170,000 units 1,709,680 149,520 31 Bal-units, h completed 149.520 a. Determine the number of units in work in process inventory at the end of the month b. Determine the equivalent units of production for direct materials and conversion costs in July. 1 1 1 EXERCISE 2-8 Costs per equivalent unit Objective 3 2. Conversion cost per equivalent unit, $7.87 2. Based upon the data in Exercise 2-7, determine the following: 1. Direct materials cost per equivalent unit. 2. Conversion cost per equivalent unit. 3. Cost of the beginning work in process completed during July 4. Cost of units started and completed during July. 5. Cost of the ending work in process. b. Assuming that the direct materials cost is the same for June and July, did the con- version cost per equivalent unit increase, decrease, or remain the same in July? nals EXERCISE 2-16 Cost of production report Objective 4 The debits to Work in Process-Cooking Department for Young Company for Jan- uary 2006, together with information concerning production, are as follows: Work in process, January 1, 1,500 pounds, 30% complete $ 6,753 *Direct materials (1,500 $275) $4,125 Conversion (1,500 x 30% * $5.84) 2,628 $6,753 SPREADSET d. $7,020 Beans added during January, 63,500 pounds 177,800 Conversion costs during January 278,080 Work in process, January 31, 1,800 pounds, 25% completed 2 Goods finished during January, 63,200 pounds 2 All direct materials are placed in process at the beginning of production. Prepare a cost of production report, presenting the following computations: a. Direct materials and conversion equivalent units of production for January b. Direct materials and conversion cost per equivalent unit for January. C. Cost of goods finished during January d. Cost of work in process at January 31, 2006. EXERCISE 2-17 Cost of production report Objective 4 Prepare a cost of production report for the Cutting Department of Velvet Carpet Company for March 2006, using the following data and assuming that all materials are added at the beginning of the process: Chapter 70.00 1,128,750 423,200 603.06 SPREADSHEET Work in process, March 1, 8.000 units, 75% complete Direct materials (8,000 X $5.20) $41,600 Conversion (8,000 X 75% x 54.80) 28,800 $70,400 Materials added during March from Weaving Dept. 215,000 units Direct labor for March Factory overhead for March Goods finished during March (includes goods in process, March 1), 214,000 units Work in process, March 31, 9,000 units, 40% completed Conversion rate, $4.85 in the Costine EXERCISE 2-7 Equivalent units of production Objectives 2, 3 o. Conversion 173,333 the Drawing Department and (b) the Winding Department. The following information concerns production in the Finishing Department for July All direct materials are placed in process at the beginning of production ACCOUNT Work in Process-Finishing Department ACCOUNT NO. Balance Date Item Debit Credit Debit Credit July 1 Bal., 10,000 units, completed 67,000 31 Direct materials, 180,000 units 396,000 463,000 31 Direct labor 558,480 1,021,480 31 Factory overhead 837,720 1,859,200 31 Goods finished, 170,000 units 1,709,680 149,520 31 Bal-units, h completed 149.520 a. Determine the number of units in work in process inventory at the end of the month b. Determine the equivalent units of production for direct materials and conversion costs in July. 1 1 1 EXERCISE 2-8 Costs per equivalent unit Objective 3 2. Conversion cost per equivalent unit, $7.87 2. Based upon the data in Exercise 2-7, determine the following: 1. Direct materials cost per equivalent unit. 2. Conversion cost per equivalent unit. 3. Cost of the beginning work in process completed during July 4. Cost of units started and completed during July. 5. Cost of the ending work in process. b. Assuming that the direct materials cost is the same for June and July, did the con- version cost per equivalent unit increase, decrease, or remain the same in July? nals EXERCISE 2-16 Cost of production report Objective 4 The debits to Work in Process-Cooking Department for Young Company for Jan- uary 2006, together with information concerning production, are as follows: Work in process, January 1, 1,500 pounds, 30% complete $ 6,753 *Direct materials (1,500 $275) $4,125 Conversion (1,500 x 30% * $5.84) 2,628 $6,753 SPREADSET d. $7,020 Beans added during January, 63,500 pounds 177,800 Conversion costs during January 278,080 Work in process, January 31, 1,800 pounds, 25% completed 2 Goods finished during January, 63,200 pounds 2 All direct materials are placed in process at the beginning of production. Prepare a cost of production report, presenting the following computations: a. Direct materials and conversion equivalent units of production for January b. Direct materials and conversion cost per equivalent unit for January. C. Cost of goods finished during January d. Cost of work in process at January 31, 2006. EXERCISE 2-17 Cost of production report Objective 4 Prepare a cost of production report for the Cutting Department of Velvet Carpet Company for March 2006, using the following data and assuming that all materials are added at the beginning of the process: Chapter 70.00 1,128,750 423,200 603.06 SPREADSHEET Work in process, March 1, 8.000 units, 75% complete Direct materials (8,000 X $5.20) $41,600 Conversion (8,000 X 75% x 54.80) 28,800 $70,400 Materials added during March from Weaving Dept. 215,000 units Direct labor for March Factory overhead for March Goods finished during March (includes goods in process, March 1), 214,000 units Work in process, March 31, 9,000 units, 40% completed Conversion rate, $4.85 in the Costine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts