Question: please explain step by step for me, thanks 21 0/1.5 points awarded Scored eBook Print References Class Quest Company had the following balances as at

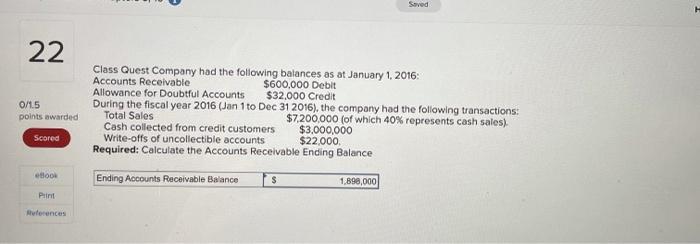

21 0/1.5 points awarded Scored eBook Print References Class Quest Company had the following balances as at January 1, 2016: Accounts Receivable $600,000 Debit Allowance for Doubtful Accounts $32,000 Credit During the fiscal year 2016 (Jan 1 to Dec 31 2016), the company had the following transactions: Total Sales $7,200,000 (of which 40% represents cash sales). $3,000,000 $22,000. Cash collected from credit customers Write-offs of uncollectible accounts Required: If the company estimates bad debts as 1% of the credit sales, calculate the ending balance in the allowance for doubtful accounts. $ Ending Allowance for Doubtful Accounts Balance 63,200 Sho 22 0/1.5 points awarded Scored eBook Print References Seved Class Quest Company had the following balances as at January 1, 2016: Accounts Receivable $600,000 Debit Allowance for Doubtful Accounts $32,000 Credit During the fiscal year 2016 (Jan 1 to Dec 31 2016), the company had the following transactions: $7,200,000 (of which 40% represents cash sales). $3,000,000 Total Sales Cash collected from credit customers Write-offs of uncollectible accounts $22,000. Required: Calculate the Accounts Receivable Ending Balance Ending Accounts Receivable Balance $ 1,890,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts