Question: Please explain step by step how to get the amortization expense in the last part Presented below is information related to copyrights owned by Marigold

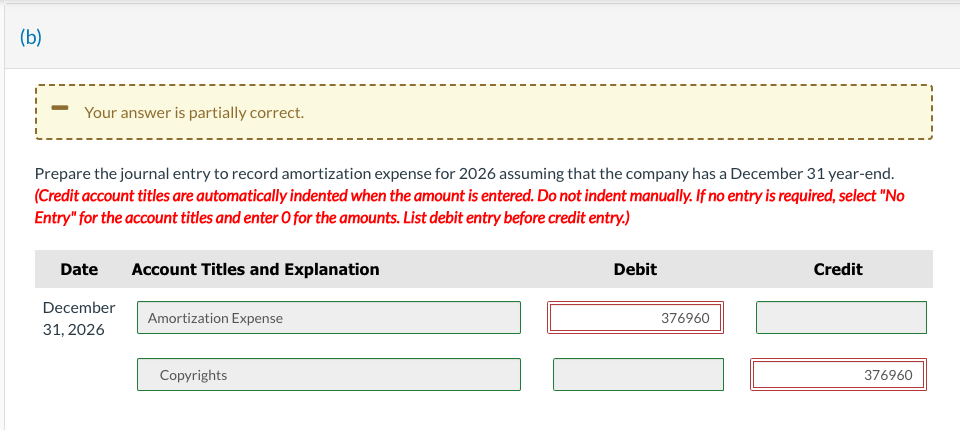

Please explain step by step how to get the amortization expense in the last part

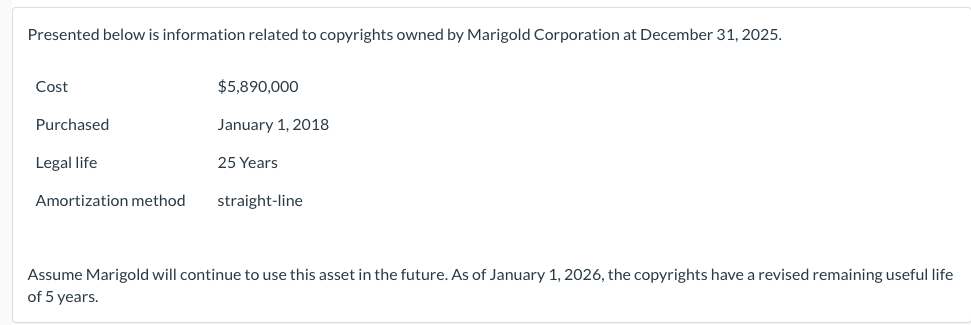

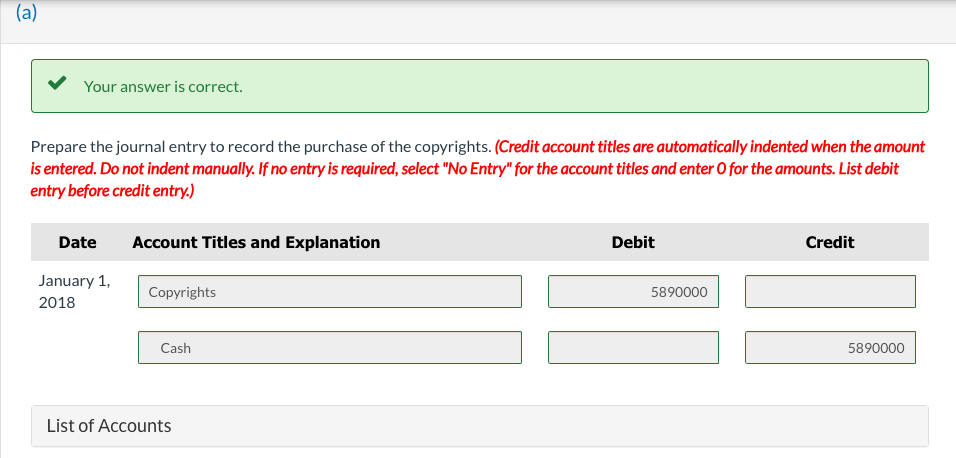

Presented below is information related to copyrights owned by Marigold Corporation at December 31, 2025. Assume Marigold will continue to use this asset in the future. As of January 1, 2026, the copyrights have a revised remaining useful life of 5 years. Prepare the journal entry to record the purchase of the copyrights. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.) Prepare the journal entry to record amortization expense for 2026 assuming that the company has a December 31 year-end. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List debit entry before credit entry.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts