Question: Please explain step by step in detail. Hand calculations would be prefered please do not use excel functions! An automobile company currently owns an assembly

Please explain step by step in detail. Hand calculations would be prefered please do not use excel functions!

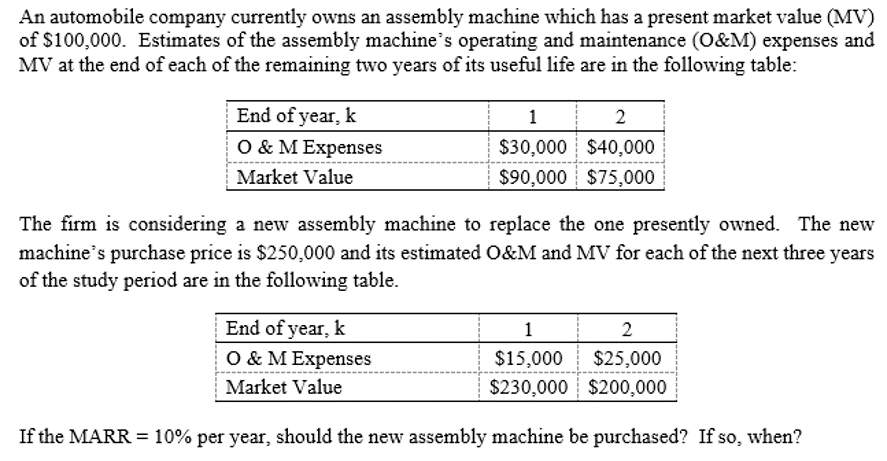

An automobile company currently owns an assembly machine which has a present market value (MV) of $100,000. Estimates of the assembly machine's operating and maintenance (O&M) expenses and MV at the end of each of the remaining two years of its useful life are in the following table: End of year, k O & M Expenses Market Value 1 2 $30,000 $40,000 $90,000 $75,000 00 si The firm is considering a new assembly machine to replace the one presently owned. The new machine's purchase price is $250,000 and its estimated O&M and MV for each of the next three years of the study period are in the following table. End of year, k O & M Expenses Market Value 1 2 $15,000 $25,000 $230,000 $200,000 If the MARR = 10% per year, should the new assembly machine be purchased? If so, when

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts