Question: please explain step by step QUESTION 3 (2 points) On July 1 2020 a family will sell their entire family company for 24,000 They are

please explain step by step

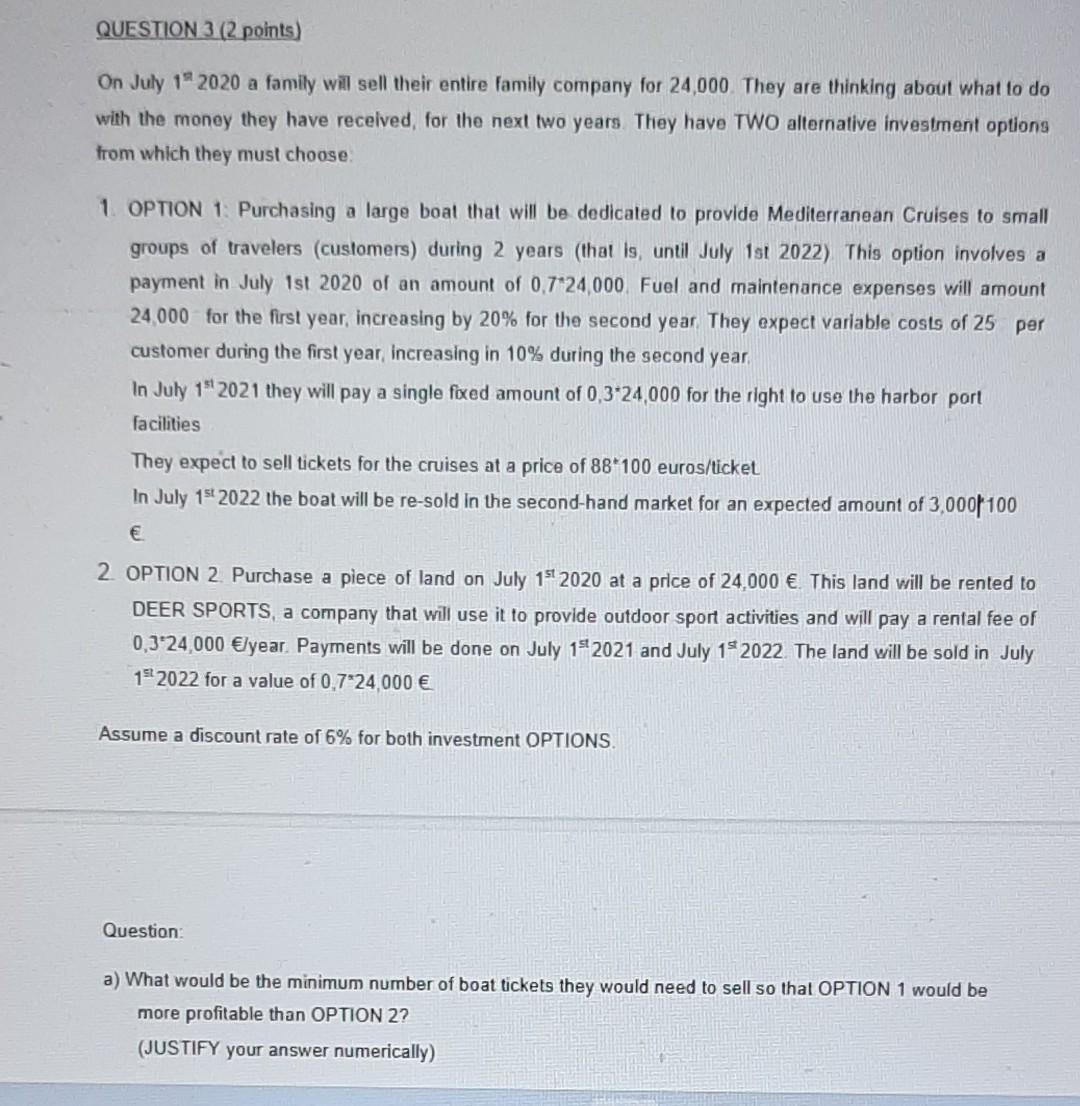

QUESTION 3 (2 points) On July 1" 2020 a family will sell their entire family company for 24,000 They are thinking about what to do with the money they have received, for the next two years. They have TWO alternative investment options from which they must choose 1 OPTION 1 Purchasing a large boat that will be dedicated to provide Mediterranean Cruises to small groups of travelers (customers) during 2 years (that is, until July 1st 2022) This option involves a payment in July 1st 2020 of an amount of 0.7*24,000 Fuel and maintenance expenses will amount 24,000 for the first year, increasing by 20% for the second year. They expect variable costs of 25 per customer during the first year, increasing in 10% during the second year In July 192021 they will pay a single foxed amount of 0.3*24,000 for the right to use the harbor port facilities They expect to tickets for the cruises at a price of 88 100 euros/ticket In July 15- 2022 the boat will be re-sold in the second-hand market for an expected amount of 3,000$100 2. OPTION 2. Purchase a piece of land on July 1st 2020 at a price of 24.000 . This land will be rented to DEER SPORTS, a company that will use it to provide outdoor sport activities and will pay a rental fee of 0,3*24,000 year. Payments will be done on July 192021 and July 152022. The land will be sold in July 1922022 for a value of 0.7*24.000 Assume a discount rate of 6% for both investment OPTIONS Question: a) What would be the minimum number of boat tickets they would need to sell so that OPTION 1 would be more profitable than OPTION 2? (JUSTIFY your answer numerically) QUESTION 3 (2 points) On July 1" 2020 a family will sell their entire family company for 24,000 They are thinking about what to do with the money they have received, for the next two years. They have TWO alternative investment options from which they must choose 1 OPTION 1 Purchasing a large boat that will be dedicated to provide Mediterranean Cruises to small groups of travelers (customers) during 2 years (that is, until July 1st 2022) This option involves a payment in July 1st 2020 of an amount of 0.7*24,000 Fuel and maintenance expenses will amount 24,000 for the first year, increasing by 20% for the second year. They expect variable costs of 25 per customer during the first year, increasing in 10% during the second year In July 192021 they will pay a single foxed amount of 0.3*24,000 for the right to use the harbor port facilities They expect to tickets for the cruises at a price of 88 100 euros/ticket In July 15- 2022 the boat will be re-sold in the second-hand market for an expected amount of 3,000$100 2. OPTION 2. Purchase a piece of land on July 1st 2020 at a price of 24.000 . This land will be rented to DEER SPORTS, a company that will use it to provide outdoor sport activities and will pay a rental fee of 0,3*24,000 year. Payments will be done on July 192021 and July 152022. The land will be sold in July 1922022 for a value of 0.7*24.000 Assume a discount rate of 6% for both investment OPTIONS Question: a) What would be the minimum number of boat tickets they would need to sell so that OPTION 1 would be more profitable than OPTION 2? (JUSTIFY your answer numerically)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts